MON, JUNE 05 2023-theGBJournal |The Nigerian equities market opened the week with mixed sentiments as losses in FBNH (-4.2%) and ZENITHBANK (-2.3%) proved sufficient in offsetting the gain in UBN (+9.7%).

As a result, the All-Share Index declined marginally by 2bps to close at 55,806.71 points. Consequently, the Month-to-Date and Year-to-Date returns remained at +0.1% and +8.9%, respectively.

The total volume traded declined by 18.9% to 369.78 million units, valued at N19.84 billion, and exchanged in 7,221 deals.

GEREGU was the most traded stock by volume and value at 52.49 million units and N16.37 billion, respectively.

Sectoral performance was largely positive, as the Oil & Gas (+2.6%), Insurance (+1.3%), Banking (+0.3%), and Consumer Goods (+0.1%) indices advanced, while the Industrial Goods index closed flat.

As measured by market breadth, market sentiment was mixed (1.0x), as 27 tickers lost relative to 26 gainers.

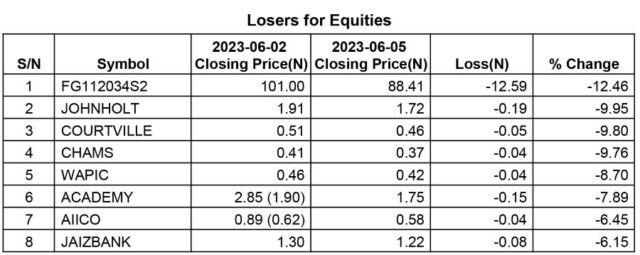

JOHNHOLT (-10.0%) and COURTVILLE (-9.8%) recorded the highest losses of the day, while NEM (+10.0%) and OMATEK (+10.0%) topped the gainers’ list.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com