TUE. 14 FEB, 2023-theGBJournal| A month ago, Coronation Research wrote that they expected market interest rates to fall during the first quarter of this year because liquidity in the financial system was likely to be high (see Coronation Research, Investment Outlook – Better Times in 2023, 11 January).

What they forecast has actually happened very quickly, with T-bill rates crashing during January and early February.

Meanwhile FGN bond rates, particularly at the long end of the curve, are holding up. What is going on?

There is no doubt that we have seen a very steep decline in T-bill rates as well as the deposit rates which banks offer to their professional counterparties. Mid-teen deposit rates that were available in December became high single-digit rates in January and then became low single-digit rates in early February.

Nigeria’s commercial banks that were in great need of liquidity in December were turning away offers of deposits in early February. The most likely explanation for this is the high level of redemptions from the FGN bond market. As well as this, the new banknote policy may be playing a role.

The Central Bank of Nigeria (CBN) planned to replace all existing bank notes with new ones by 10 February, an action which is being challenged in the courts. The policy is forcing holders of old bank notes to deposit them while attempts to withdraw these sums from ATMs are stymied by shortage of new bank notes – witness the queues outside ATMs.

This results of these two dynamics are large amounts of Naira sitting on banks’ balance sheets. These sums make their way to the short-term money markets, depressing T-bill rates.

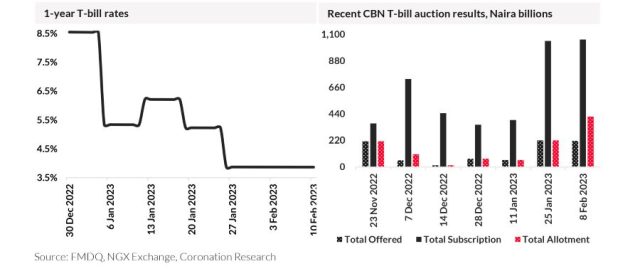

The evidence for this comes from recent T-bill auctions. The level of supply of T-bills, i.e., the amount offered by the CBN at each auction, generally follows a pattern of rolling over redemptions of existing bills.

The level of supply in January and early February has not been not unusual. What has changed is the level of subscription, which rocketed to over N1.0 trillion (see chart). The response of the CBN has been to allow rates T-bill rates at auction to fall.

FGN bond rates and issuance

This CBN’s actions in its T-bill auctions contrast with those of the Debt Management Office in its FGN bond auctions. Offers and allotments of FGN bonds have increased as the DMO sets out to borrow much more than it did last year.

We can see this in the DMO’s issuance calendar for Q1 2023, where the outline plan is to borrow N360.0bn in each of January, February and March as opposed to N150.0bn for these months a year ago.

The level of subscription at FGN auctions has been high (see chart) and the DMO has taken advantage of this by making large allotments. At the most recent auction on 30 January the scheduled offer of bonds (across four maturities) was N360.0bn but the eventually allotment was N662.6bn.

The DMO allotted roughly 82% of the subscription level. This gives the DMO the ability to front-end load its sales of FGN bonds in 2023 by selling almost twice (1.84x) its scheduled offer. At the same time, it means that the DMO has to offer quite juicy interest rates in order to keep investors happy. So FGN bond rates remain quite high.-With Coronation Research

Twitter-@theGBJournal| Facebook-the government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com