...African private capital activity remains remarkably resilient despite global uncertainty and volatility

TUES, MAY. 02 2023-theGBJournal|The African Private Capital Association (AVCA) today announced the release of its 2022 African Private Capital Activity Report.

Key findings:

-626 reported deals in 2022, a 46% year-over-year increase.

-US $7.6bn raised in investments.

-82 exits recorded in 2022, indicating a remarkable year-over-year increase of 2.3x.

-Sales to Trade Buyers was the most preferred exit route.

-US$2.0bn was the total value of final closed funds in 2022

-US$1.7bn reached in interim closes

The authoritative annual report offers deep insights into private capital fundraising, investments and exits in Africa, sharing extensive data and analysis across investment strategies covering private equity, private debt, venture capital, infrastructure, and real estate activity – across all subregions.

African private capital markets experienced a record-high volume of deals in 2022. As a result, deal volumes in the region recorded a remarkable 46% year-over-year (YoY) growth. In 2022, 626 deals took place, a favourable increase amidst broader global trends, where deal volumes and value retreated in line with growing economic uncertainty into H2 2022, declining by 15% and 26%, respectively.

The report reaffirms Africa’s position as a bankable investment destination and is the only market worldwide to have experienced growth in both the number of deals closed and capital invested. US$7.6bn of private capital was invested in 2022, marking a 3% year-on-year growth in deal values across the continent throughout 2022.

This activity was driven by record growth in mid-market (US$10mn – 49mn) and larger-sized (US$50mn – 100mn) deals. Catalysed by venture capital deal flows, 2022 attracted the second-highest private capital investment over the last decade.

On the other hand, while the fundraising value in 2022 experienced a 54% YoY decrease, more funds raised capital in 2022 than the year before. Much of this activity was led by capital raises between US$100mn and US$250mn.

Venture capital continues to dominate private financing

Reflecting Africa’s changing demography, VC was the most active asset class, accounting for 74% of the total private capital deal volume and over half of private capital deal value. As a younger, more tech-oriented population drives interest in disruptive sectors – investments in tech secured the largest part of all investments recorded last year on the continent.

According to the new report, regulatory reforms involving greater protection of intellectual property rights and removing barriers to accessing funding sparked innovation in the start-up ecosystem, boosting investor confidence. This has encouraged more investment into industries integrating technology into their services, such as healthtech, which is moving upwardly.

Private equity activity in Africa experienced a resurgence, with a 24% YoY increase in the number of deals, and a 31% YoY increase in the value of those deals. Private debt, an asset class offering diversification and investment protection during periods of economic volatility, attracted significant interest in 2022 with activity in the asset class across Africa growing 7.2x YoY.

Investors continue commitments to familiar regions and sectors

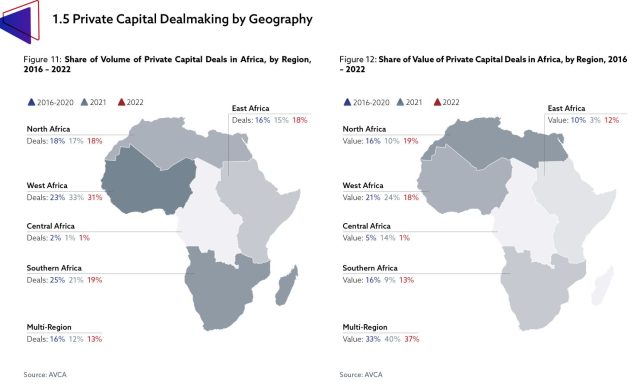

West Africa witnessed the most private capital deals on the continent, spearheaded by Nigeria, with over half of the deals in the region concluded in Africa’s largest economy.

The growth of private equity in South Africa, the continent’s most industrialised economy, reversed years of decline in investments in the wider Southern African region. Last year saw a surge of activity in the region boosted by growth in deal values increasing across Private Equity and Infrastructure.

Investment activity in North Africa continued to gain traction and noted a 52% YoY increase in deal volume in 2022, while the deal value in 2022 near-doubled the investment value recorded in the previous year.

East Africa also experienced a rise, with a 71% increase in deal volume and a 4x increase in deal value, marking its highest-grossing year in a decade.

Multi-region investments accounted for the largest deal volume, with investors channelling 37% of the total value of investments into portfolio companies with operations in more than one African economy. The Financials sector has benefited from this borderless approach.

The sector’s prominence across private capital deal volume (29%) and value (32%) made it the most attractive sector again, a trend expected to continue.

Consumer discretionary services, holding the second position, have been lifted by growing interest in the education, hospitality, and retail sectors.

Companies exit record number of investments

Last year marked a record number of successful exits, with 82 exits spread across all sub-regions. The 2.3x YoY increase in exits across Africa, dominated by the financial sector, follows a bottleneck of delayed exits post-Covid.

Last year, private capital fund managers prioritised asset disposal, the majority of which occurred in North Africa. Trade sales comprised nearly half of all exits, with PE and financial buyers accounting for nearly a quarter. Exits through IPOs and capital markets marked a record high.

Abi Mustapha-Maduakor, Chief Executive Officer at AVCA, commented: “In the face of highly challenging global economic conditions, our industry saw an impressive number of exits – the most in history. The growing diversity of asset classes in the private capital ecosystem unlocks broader investment opportunities across exciting geographies and represents a marketplace finding more solutions in response to our transforming economy. We are delighted to see strong performance in venture capital and growth in private equity and private debt. As our industry matures, AVCA’s metrics mark the evolution. We look forward to building on our organisation’s role as an enabler of growth and investment.”

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.ng| govandbusinessj@gmail.com