SAT, JUNE 10 2023-theGBJournal |Treasury bills and FGN Bonds secondary market closed the week attracted to investors.

Proceedings in the Treasury bills secondary market were tempered at the start of the week, but turned bullish as the average yield dipped by 9bps to 6.3%.

The combined impact of the healthy system liquidity and market participants moving to the secondary market to compensate for lost bids at Wednesday’s PMA spurred market performance.

At the auction, the CBN offered bills worth N182.85 billion – N1.03 billion of the 91-day, N1.94 billion of the 182-day, and N179.89 billion of the 364-day – to market participants.

Demand was higher, especially for the 364-day bill (bid-to-cover: 4.5x), as the total subscription settled at NGN815.61 billion.

Eventually, the CBN allotted exactly what was offered at respective stop rates of 4.48% (previously 2.29%), 6.00% (previously 4.99%), and 9.45% (previously 7.99%).

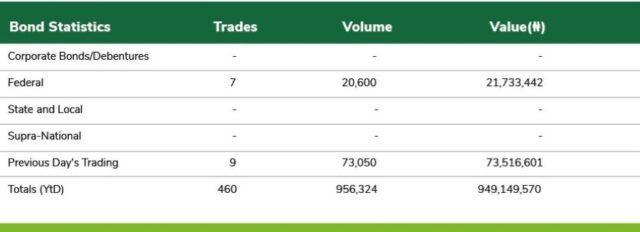

At the FGN Bonds secondary market, we maintain our view that frontloading of significant borrowings for the year by the FG will result in an uptick in bond yields, as investors demand higher yields in the face of elevated supply.

Meanwhile, activities in the market remained bullish as investors continued to cherry-pick attractive bonds across the curve.

Accordingly, the average yield across all instruments declined by 12bps to 13.8%. Across the benchmark curve, the average yield contracted at the short (-26bps), mid (-10bps), and long (-5bps) segments, following investors’ demand for the MAR-2027 (-43bps), APR-2032 (-16bps), and APR-2049 (-14bps) bonds, respectively.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com