…The IMF thinks debt/GDP will fall from 93% to 88% in 2024. Nonetheless, scary stuff. Ghana, Zambia and Sri Lanka all had ratios in or close to that box until they defaulted.

…We should be very cautious about looking at debt to GDP ratios in Africa – when GDP gives such a misleading impression of a country’s state effectiveness. Eg Nigeria is not the biggest economy but the 5th biggest if we think about revenues.

By Charlie Robertson

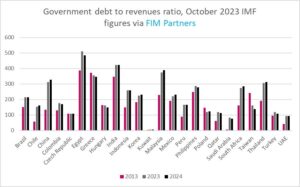

WED, OCT 11 2023-theGBJournal| With rising interest rates making us focus more on debt – it won’t surprise any debt investors that in MSCI EM, the government debt to government revenues ratio is highest in Egypt.

But I suspect most equity investors don’t know that India is second.

Now I’m a big fan of India (see The Time Travelling Economist) but I’m also a fan of ASEAN nations which have the same double demographic dividend and they don’t carry the same debt ratio.

It’s not a coincidence I’m at FIM Partners, where FIM’s Frontier fund has over 50% exposure to Indonesia, Vietnam and Philippines.

India’s weakness on revenues is a south Asian theme, hence Pakistan’s economic crisis and Sri Lanka’s default. Even Bangladesh doesn’t do great – PS, anyone has a friend in Dhaka who’d entertain my 23 year old son in Dhaka for an hour or two, over the next month, do let me know.

China’s debt/revenues ratio is rising significantly – and will continue to rise – given my “China = Japan + 35 years” working assumption. More fiscal stimuli means more Chinese debt.

What else should I flag? That Kuwait, Saudi and UAE are 1st, 2nd and 3rd best on this metric. FIM has a MENA fund for them too

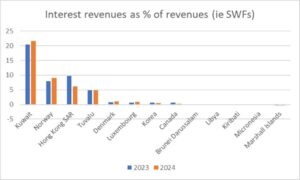

In fact, Kuwait gets richer when interest rates rise – because it’s SWF is so big – more so than anyone else in the world. A-ha, Norway.

Turkey and the US are going to see 10% of all their government revenues go on interest payments next year.

But I suspect that’s not what you’re looking at in the chart below.

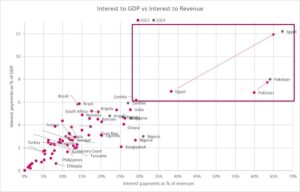

Egypt, which is already enduring a tough 2024 (IMF figures for 2004 refer to fiscal year 2023/24) – with over 60% of revenues being spent on interest, like Pakistan which has already managed for such a ratio for a year.

Egypt does come out poorly in the latest IMF figures, thanks to a budget deficit that will double to over 10% of GDP in 2024, owing to their high debt and high interest rates – and because so much of their debt is domestic.

Its interest payments as a % of revenues are forecast to be the worst in the 190 countries the IMF forecasts for this data. It tells us why the CBE is reluctant to push interest rates much higher.

The silver lining is that Egypt’s debt 1) is largely locally held, and 2) is largely in domestic currency, so inflation does help erode it away.

The IMF thinks debt/GDP will fall from 93% to 88% in 2024. Nonetheless, scary stuff. Ghana, Zambia and Sri Lanka all had ratios in or close to that box until they defaulted.

Looking at MSCI Frontier (below) – no surprise Pakistan comes out top and South Asia isn’t great at collecting budget revenues (see Bangladesh too). More interesting is that Tunisia comes out well.

Kazakhstan and Romania among the best – and Vietnam pretty good (better than China 10 years ago).

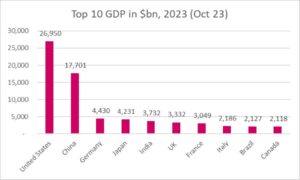

World GDP is estimated at $104 trillion in 2023 (up from the “easier to remember” $100 trillion in 2022).

US is ¼ (26%) of the world economy at $27 trillion, so 50% larger than

China at 1/6 (17%) or $18 trillion.

China is larger than Germany, Japan, India and the UK put together (15%).

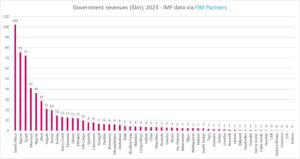

When we look at economic size, using government revenues as the best proxy for the size of the effective state – SA is the biggest (effective) state in Africa, nearly 3 times larger than Nigeria.

Algeria is the 2nd biggest (effective) state in Africa – Egypt is 3rd. There are 16 countries (I include “no data” Eritrea) with annual government revenues of $1bn or less.

Given the gap between official and parallel market rates – these numbers overstate $ revenues in Egypt, Nigeria, Angola and Ethiopia among others.

We should be very cautious about looking at debt to GDP ratios in Africa – when GDP gives such a misleading impression of a country’s state effectiveness. Eg Nigeria is not the biggest economy but the 5th biggest if we think about revenues.

Conclusion: MENA is coming out well in a strong dollar, higher interest rate environment – at least from a macro perspective. Personally I think India is risker than the market does, and FIM offers less risky ASEAN alternatives that are experiencing the same double demographic dividend I focused on in the Time Travelling Economist.

Egypt has followed Pakistan into an acutely difficult phase – perhaps a new reformist govt can make a difference after Dec-23 elections, but the market is understandably pricing the debt sceptically.

Lastly, on the debt side, I’m more comfortable with ratios that focus on actual revenues than on notional GDP which doesn’t help a govt raise taxes.

Charlie Robertson, Head of Macro Strategy, FIM Partners UK Ltd

Twitter(X)-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com