…What are the effects of rising Nigerian Treasury Bill (T-bill) yields on savings?

….While those owing money face challenges as the cost of borrowing increases, those with cash to save have better opportunities than they have had in years.

…Although T-bill yields, and the yields of Nigeria’s Money Market Funds, do not exceed inflation, they are attracting money into the savings industry, an important factor in economic stabilisation.

TUE OCT 22 2024-theGBJournal| The total value of Nigeria’s mutual fund industry crossed the Naira 3 trillion threshold this year, helped by a rise in the value of Money Market Funds past the N1 trillion mark.

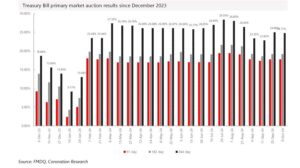

The rise in Treasury Bill (T-bill) rates is making these funds increasingly attractive to savers as alternatives to bank deposits. And, as yields on 1-year T-bills exceed those of Federal Government of Nigeria (FGN) bonds, Naira-denominated Fixed Income Funds have been losing ground.

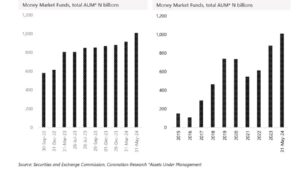

Although the available data are not particularly fresh (the data we are using come from the end of May2024), we can discern a positive trend in Nigeria’s Money Market Funds, with their total assets under management (AUM) standing at just over N1 trillion at the end of May, 15% higher than the N869.3 billion reported for December 2023.

This is important data for the health of the mutual fund industry. Money Market Funds make up 33% of the industry’s total AUM, only exceeded by the 47% held in US dollar and Eurobond funds (we group these two US dollar categories together).

The past eight years have delivered mixed results for Money Market Funds, with investors losing faith with them as market interest rates fell after 2019. The total assets under management (AUM) of Nigeria’s Money Market funds rose by a compound annual growth rate of 76% from 2012 to 2019 (58% in inflation-adjusted terms) but only grew by 4% per year between the beginning of 2020 and the end of 2023 (falling by 13% per year in inflation-adjusted terms).

The key to their recovery is the rise in T-bill rates, which has taken hold in 2024. This change takes time to feed through into Money Market Funds’ yields, because old bills (with low yields) must mature (or be sold) before the new high-yielding bills can be bought. This why we are optimistic that the upswing in Money Market Funds will continue throughout this year.

Written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com