FRI. 24 FEB, 2023-theGBJournal| In line with expectations, the oil sector’s contraction moderated to 13.38% y/y in Q4-22 (Q3-22: -22.67% y/y).

The moderate contraction reflects higher crude oil production (albeit significantly below the country’s OPEC+ quota; 1.83mb/d), reflective of the government’s efforts at tackling crude oil theft and vandalism in the review period.

Notably, crude oil production settled higher at an average of 1.34mb/d in the review period (Q3-22: 1.20mb/d). A breakdown of the data provided by the Nigerian Upstream Regulatory Commission (NUPRC) showed that the Bonny, Forcados, Brass and Escravos terminals primarily contributed to the increased crude oil production in Q4-22 relative to Q3-22.

Overall, crude oil production (including condensates) averaged 1.37mb/d in 2022FY (-14.7% y/y vs 2021FY: 1.60mb/d) on account of the synchronous impacts of massive oil theft and pipeline vandalism, retrenchment of large International Oil Companies (IOCs) from onshore oil exploration, and lagging impacts of decrepit infrastructure.

Oil GDP Outlook:

Cordros Research expects crude oil production to maintain its slight increases over the short term in line with the government’s recent efforts at curbing crude oil theft and vandalism.

Indeed, data from the NUPRC shows that aggregate crude oil production (including condensates) increased by 5.7% m/m to 1.49mb/d in January (December 2022: 1.41mb/d).

‘’Thus, we expect crude oil production, including condensates, to average 1.50mb/d in Q1-23, translating to an optimistic growth estimate of 0.67% y/y.

However, we believe that for Nigeria to achieve crude oil production up to the country’s OPEC+ production quota (1.83mb/d), the government will need to incentivise investment in new production capacity and invest in the proper training of indigenous firms to handle the divested IOC’s assets,’’ Cordros said their review of Q4-22 GDP growth report.

On the other hand, the non-oil sector remains the engine of overall GDP growth.

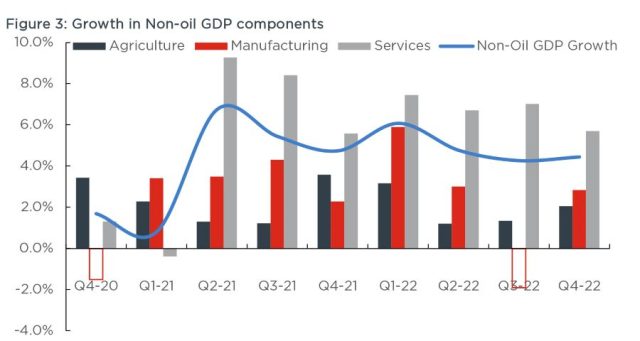

The non-oil sector grew stronger in Q4-22, increasing by 4.44% y/y relative to +4.27% y/y in Q3-22. Analysing the outturn, increases across the Services (+5.60% y/y vs Q3-22: +7.01% y/y) and Agriculture (+2.05% y/y vs Q3-22: +1.34% y/y) sectors neutered the contraction in the Industries (-0.94% y/y vs Q3-22: -8.00% y/y) sector, and supported the growth.

We note that the persistent decline in the Industries sector is consistent with the country’s lingering challenges surrounding crude oil production and refining. For 2022FY, we highlight that the Services sector grew by 6.66% (2021FY: +5.61%), while the Agriculture sector grew slower by 1.88% (2021FY: +2.13%).

Meanwhile, the Industries sector declined at a faster pace; it contracted by 4.62% (2021FY: -0.47%).

Non-Oil GDP Outlook:

Aside from the pre-existing challenges, Cordros say they expect the non-oil sector’s growth to moderate significantly in Q1-23 because of how the current demonetisation drive is disrupting economic activities, particularly in the services and manufacturing sectors.

Election uncertainties are also expected to constrain activities in the non-oil sector. Hence, we project the non-oil sector will grow by 1.98% y/y.

For the Agriculture sector, Cordros they expect the increased security challenges associated with the build-up to the general elections to constrain farming activities, limiting agricultural output. Similarly, we expect the lower fertiliser usage arising from the lingering high prices to constrain farm activities, limiting crop production.

‘’Therefore, we estimate that the agriculture sector will grow by 1.88% y/y in Q1-23.’’

On Services, our first spotlight is on the Trade sub-sector. Domestic trade activities continue to witness intermittent disruptions in line with the policy maker’s back and forth on the deadlines for old high denomination notes to cease being legal tenders and cash crunch given the significantly low supply of new naira notes.

More disturbing is the low-ticket transactions traders’ distrust of digital payments, slowing down their sales, more so that many buyers are experiencing cash shortages to pay for goods and services.

Similarly, the people are now rejecting the old N1000.00, and N500.00 notes as a means of exchange after President Buhari’s address on 16 February. We understand that the N1,000 and N500 notes constitute 54.0% and 28.0% of currency in circulation as of December 2022. This is not surprising, given the country’s high inflationary environment.

Consequently, unless there has been a drastic change in the composition of N1,000 and NGN500 notes since December 2022 (which is unlikely in our view), we expect trading activities to be significantly hampered in the near term, more so that the supply of new notes remains low. Thus, we project the Trading sub-sector’s growth to moderate considerably to 1.21% y/y, weighing down the service sector. Away from Trade, we expect the ICT sub-sector to maintain its solid growth pace because of the continued strong voice and data traffic growth. However, the ICT’s growth is likely to moderate compared to the prior quarter, given the high base effects from the prior year’s corresponding period.

Elsewhere, while the relatively improved macroeconomic environment would spur banks to maintain the current quantum of risk assets, the financial institution’s growth will likely moderate given the combined impact of tighter monetary conditions, which are likely to limit the growth of credit creation and unfavourable base effects from the prior year. Therefore, on a balance of factors, we expect the Service sector to grow by 2.68% y/y.

Manufacturing: Aside from the high production costs exacerbated by high energy prices, elevated borrowing costs and FX constraints, we expect the lingering cash crunch to also negatively impact the Manufacturing sector. We understand that producers are now producing below capacity, given the low consumer spending associated with cash shortages and the cessation of N1000 and N500 as legal tenders.

In addition, heightened uncertainties regarding the election outcome are also expected to limit production in Q1-23. Accordingly, we forecast a 1.57% y/y growth in the Manufacturing sector in Q1-23.

Having factored in the upside and downside risks, Cordros have revised their estimates for Q1-23 and 2023FY growth downwards to 1.89% y/y (Previously: 2.44% y/y) and 2.70% y/y (Previously: 3.02% y/y), respectively.

Twitter-@theGBJournal| Facebook-the government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com