Tag: INTEREST RATE

CBN’s rate cut a positive growth signal, but transmission and fiscal...

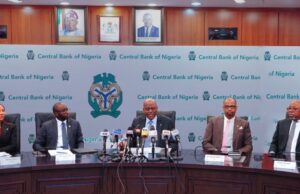

WED FEB 25 2026-theGBJournal| The recent interest rate cut by the Central Bank of Nigeria (CBN) Monetary Policy Committee (MPC) by 50 basis points...

Central Bank of Nigeria delivers first easing signal, cuts interest rate...

By Charles IKE-OKOH

TUE FEB 24 2026-theGBJournal| The Central Bank of Nigeria (CBN) has trimmed its benchmark interest rate by 50 basis points to 26.50...

The Big Question| Will Central Bank of Nigeria MPC lower the...

...For now, caution appears to be the prevailing bias—but the door to easing is gradually opening if inflation continues to cool and external buffers...

Quick Take| Central Bank of Nigeria strangles banks scope to recycle...

THUR SEPT 25 2025-theGBJournal| When The Central Bank of Nigeria (CBN) on September 23, 2025 cut benchmark interest rate from 27.5 percent to 27...

Sustained improvements in key indicators test CBN’s resolve on interest rate

MON SEPT 22 2025-theGBJournal| As the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) begins its rate decision meeting today, analysts...

Central Bank of Nigeria holds key rates steady, MPR stays at...

TUE JULY 22 2025-theGBJournal| The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) on Tuesday kept interest rates steady amid expectations...

Quick Take| With inflation cooling, will the Monetary Policy Committee hold...

...The benchmark rate has been held at the current 27.5% since November 26th, 2024, during the CBN's 298th meeting, unchanged for a little over...

MAN fumes at CBN interest rate decision, says current policy trajectory...

WED MAY 21 2025-theGBJournal| The Manufacturers Association of Nigeria (MAN) today slammed the decision of the Monetary Policy Committee (MPC) of the Central Bank...

Nigeria’s Central Bank Monetary Policy Committee holds Monetary Policy Rate at...

THUR FEB 20 2025-theGBJournal| In line with expectations, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held the Monetary Policy...

What could CBN’s interest rate hike mean for markets

...What happens in the markets as investors digest the Central Bank of Nigeria (CBN) Monetary Policy Committee (MPC) interest rates decision.

WED NOV 27 2024-theGBJournal|...