Tag: forex

As the CBN sustained its intervention the Naira fell 0.2% at...

SAT JUNE 01 2024-theGBJournal|The naira appreciated to a month high of N1,173/USD on 28 May before closing the week at N1,485.99/USD (-0.2% w/w) at...

Nigeria’s FX reserves up US$195.01 million to US$32.64 billion as Naira...

SAT MAY 18 2024-theGBJournal|The value of the Naira to the dollar weakened by 212 bps week-on-week to print at N1,497.33/$ this week at the...

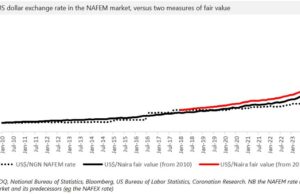

Analysis| Fair value and the Naira

...How do we measure fair value? There are many ways, but here we focus on just one, the inflation differential

TUE MAY 14 2024-theGBJournal|Currencies do...

Naira ends week at N1,466.31/US$; gross reserves level jumps by US$89.76...

SAT MAY 11 2024-theGBJournal|The naira depreciated by 4.5% to N1,466.31/USD at the Nigerian Autonomous Foreign Exchange Market (NAFEM), as the total turnover (as of...

Nigeria’s FX reserves settle higher as Naira value tumbles 457 bps...

SAT MAY 04 2024-theGBJournal|The value of the Naira to the dollar weakened by 457 bps week-on-week to print at N1,400.40/USD this week at the...

NGX All-Share Index closes 1.39% w/w down as Naira plumets by...

...Nigeria’s FX reserves paused the five-week descent as the gross reserves level increased by US$10.76 million to US$32.12 billion (24 April).

SAT APRIL 27 2024-theGBJournal|Over...

Nigeria’s FX reserves diminished by USD502.99 million w/w, Naira crashes to...

SAT APRIL 20 2024-theGBJournal| Nigeria’s FX reserves fell substantially this week, as gross reserves fell by US$502.99 million w/w to a seven-year low of...

Performing naira rises 9.5% to N1,142.38/US$, NAFEM turnover falls by 86.3%...

SAT APRIL 13 2024-theGBJournal| The naira further appreciated by 9.5% to NGN1,142.38/USD at the Nigerian Autonomous Foreign Exchange Market (NAFEM) at the close of...

Central Bank of Nigeria sells forex at N11O1/$1 to BDCs

MON APRIL 08 2024-theGBJournal| The Central Bank of Nigeria (CBN) Monday sold $10, 000 to Bureau de Change (BDCs) operators at the rate of...

Naira closes its best week at N1,309.39/US$ with gross reserves slumping...

THUR, MAR 28 2024-theGBJournal| The local currency, the naira closed out the weeks official trading up by 9.3% to N1,309.39/US$1 at the Nigerian Autonomous...