…The US current status in corporate defaults this year reached 118 by September, nearly double the 2022 total

…The US saw a strong housing market in the post-COVID-19 recovery, with low interest rates driving demand.

…Economists broadly expect the global economy to slow next year but avoid a deep recession.

By Rebecca Ellis

MON, DEC 04 2023-theGBJournal|This year has been a year of waiting and questioning of whether or not there will be a global recession.

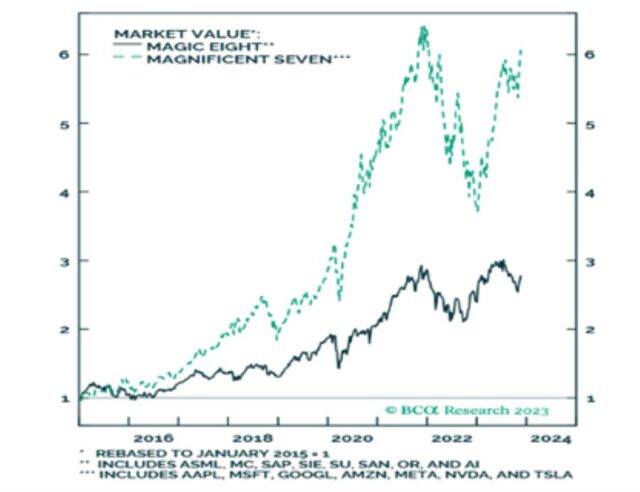

Market growth has been singularly lopsided: 15 stocks have ruled the world and given us 76% performance whereas the rest of the broader index components have been flat, making the recovery of 2023 very skewed to AI and specific hi-tech gems.

Any rationale investor recognizes this is not sustainable and the direction of the market, though pleasant to see, must be taken with a pinch of reality; this is by no means a broad recovery.

Throughout this year, we have continued to reiterate that investors should deploy caution. The timing of the market is a difficult challenge, even for star investors such as Warren Buffet and other Wall Street legends; it remains fundamentally important to adapt to volatile conditions and minimize any negative impacts of adverse market moves.

Today, we will look to the year ahead to examine how investors should act when faced with the challenges presented by the uncertain timing and depth of a potential recession and the extent of its impact.

Firstly, what is the “Santa run” in the financial markets?

The term “Santa Claus Rally” refers to a phenomenon where the stock market experiences a rally throughout December and the first two trading days of January. This period is sometimes associated with increased optimism and positive sentiment among investors.

Will the optimism last into 2024?

Optimism may remain if we see what is termed a soft landing “where there is a small correction and the economy bounces back without significant unemployment”. The key requirement for this to happen is a resilient job market.

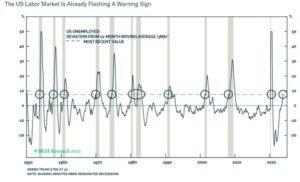

Taking a look at this indicator in December 2023, we are seeing unemployment is rising and nearing the closely watched ‘Sahm rule’ threshold; historically this indicates a recession is underway when the three-month rolling average of the unemployment rate rises half a point above the low of the prior 12 months.

And in 2023 we are just below this threshold in the US economy. We also see in the chart below, which considers unemployment and past recessions, that warning signs a recession is near are coming in loud and clear:

What are the other key indicators and how are they fairing for the US economy?

Gross Domestic Product “GDP”- A measure of a country’s economic performance. A significant contraction in GDP can signal a recession.

The U.S. current status has a healthy number of 5.2% for quarter 3 and looks to remain strong for the rest of the year.

Consumer Spending – A critical driver of economic activity. A decline in consumer spending can be a red flag.

The current status for the U.S. saw consumer spending decelerated in Q3 which is a sign that the skies may become darker in the future.

Corporate Defaults – A rising rate of business failures and an increase in corporate defaults can be a sign of economic stress. Companies will struggle during periods of economic downturn, facing reduced consumer spending, higher operating costs, and challenging financing conditions.

The US current status in corporate defaults this year reached 118 by September, nearly double the 2022 total, according to S&P Global, a worry for policymakers watching the impact of rate hikes whose effects take place with a time lag.

Housing Market Indicators – Housing starts, home sales, and prices can reflect broader economic conditions.

The US saw a strong housing market in the post-COVID-19 recovery, with low interest rates driving demand. However, with the higher rate interest environment, we have seen this falling into a 13-month low in October 2023.

In conclusion, economists broadly expect the global economy to slow next year but avoid a deep recession.

What are experts saying in the market?

“The equity market is too optimistic right now and bond markets have it right,” said Altaf Kassam, head of investment strategy and research, EMEA, for State Street Global Advisors.” There is still room for interest rates to come down and disinflation to continue but we think for that to happen growth will also slow down and the lagged effect of monetary tightening will come.”

Joost Van Leenders, senior investment strategist at Dutch bank Van Lanschot Kempen, said he expected U.S. and European equities to fall from here as monetary tightening impacts the economy. U.S. home sales slumped to a 13-year low in October, eurozone bank lending to businesses fell for the first time since 2015 last month as a recession in the bloc looms, while data on Thursday showed China’s manufacturing activity fell deeper into contraction in November. “It’s all the more difficult (for company earnings) when inflation is falling,” he said.

In conclusion, what are our expectations for 2024

We are remarkably close to entering a recession and Q1 has been voted by analysts as the time that this will occur.

We are also seeing some other black swan events emerge which will keep instability high over the next year at least. The sounds of another Asian flu/respiratory issue in China could be something we are not factoring in.

This, depending on the extent of any illness in arrival could pivot the global economy into a deeper contraction. Therefore, active management of your portfolio with a strong bias in sectors such as healthcare and defense is our key to navigating the continued choppy waters ahead.

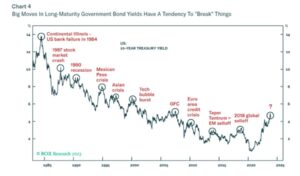

If all that is not enough, spiking government bond yields rarely herald good news and that a recession is beckoning.

In the spirit of the season, we want to express our gratitude for your resilience and commitment throughout a challenging year. Your trust in my team’s services means the world to us.

May the holidays bring you well-deserved rest and the New Year usher in brighter days for your investments. We look forward to another year of growth and achievement together.

Rebecca Ellis, Family office advisor, Geneva, Switzerland| Co-author Martin de Sa Pinto, Martin de Sa Pinto Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com