…Businesses are gearing up for a challenging year ahead but remain extremely curious about investigating how AI can make leaps of efficiency.

…With anticipated growth trajectories, investors can confidently allocate to equity, and the US is expected to provide positive returns.

By Rebecca Ellis

TUE, FEB 06 2024-theGBJournal|The beginning of the year saw the markets hold their breath until the 17th of January, when a ray of hope entered through a bullish forecast from Taiwan Semiconductor Manufacturing Co (TSMC).

Their announcement regarding AI chip orders and the growing significance of key clients, Apple and Nvidia, has further solidified the belief that AI will continue to revolutionize business.

In addition to this optimistic market sentiment, US GDP soared by 3.3% in the fourth quarter, surpassing the forecast of 2%, fortifying the likelihood of a soft landing for the economy.

Concurrently, both US manufacturing and services sectors have re-entered the expansion zone. The expectation of a recession is diminishing, leading the S&P 500 to achieve new all-time highs as interest rate adjustments are expected sooner rather than later.

In the first article of 2024, we explore what lies ahead in the coming year and take some insights from the annual Davos event-(https://www.govbusinessjournal.com/swiss-perspective-will-the-santa-run-bring-us-good-or-bad-news-for-2024/)

The key takeaways from Davos

Davos serves as the primary event for the World Economic Forum, where business leaders and politicians convene to discuss the economy and set expectations for the year ahead.

The prevailing sentiment at the annual snowy gathering was encapsulated as “life is not bad but not great.”

– The “not bad” feeling was drawn from the resilience of major economies, avoiding a descent into recession.

– The “not great” mood reflected concerns about central banks’ ability to balance their economies amidst the twin challenges of inflation and recession.

The optimistic mood that AI could yield positive outcomes was counter-balanced by the reality that economies face volatility due to ongoing conflicts and potential political shifts, with protectionist and right-wing parties gaining ground. Preparing for a challenging year, businesses wished to focus on how AI can improve efficiencies.

An intriguing development at Davos, contrasting starkly with the preceding year, was the central focus on AI and the amount of side meetings dedicated to various aspects of AI. Only a year ago, ChatGPT was in its infancy, and now it stands as the poster child of AI.

Striking the right balance between active integration and a measured approach will be crucial. As mentioned by Novartis CEO Vasant Narasimhan, the drugmaker is collaborating with Microsoft to expand the use of AI.

The goal is to provide tools to employees who handle 20 to 30,000 regulatory responses annually. This highlights the business’s commitment to leveraging AI for enhanced operational efficiency rather than displacing workers.”

The conclusion is that businesses are gearing up for a challenging year ahead but remain extremely curious about investigating how AI can make leaps of efficiency.

The AI Driver

The TSMN earnings call sprung the AI theme back into life and the share prices of those companies who are integral in this area continued their magnificent run of 2023. Despite reporting slightly lower profits compared to the previous year, it was deemed a success given the challenging conditions.

Alongside the Davos event, this underscores that businesses are pivoting towards AI to capture the early benefits, with key advantages including automation, efficiency, data analysis, personalization, innovation, and cost reduction.

With the earnings season gripping onto this positive news, the fact that the real economy’s slowdown has not translated into massive job losses, despite depleted savings and historically high levels of credit, suggests a robust outlook for avoiding a recession.

With anticipated growth trajectories, investors can confidently allocate to equity, and the US is expected to provide positive returns. If moderate job losses persist, the consensus remains intact.

Most companies are poised to thrive when financial conditions improve, and the eagerness for business to see this happen through interest rate cuts earlier rather than later is adding some additional expectation to central banks. From the initial meetings so far, this is expected to materialize by mid year to Q3. Analysts anticipate an 8% increase in the S&P500 price over the next 12 months.

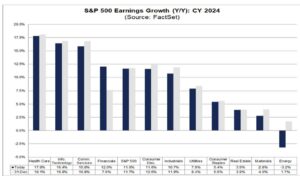

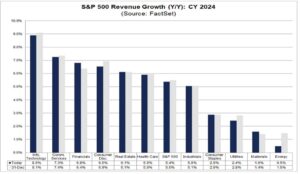

Below we show from the research house Factsheet the expectation of the US economy by sector and this shows the consensus that the year will be positive.

A volatile year ahead

However, 2024 is not expected to be smooth sailing; it is anticipated to be a volatile year ahead. With 40% of the world participating in elections influencing economic and global trade, the US election in November is poised to be a contentious event.

Beyond these critical events, democracy is facing challenges globally, as evidenced by Germany’s strong reaction to a right-wing political gathering. Although Germany is not in an election year, the rejection of fascism and mass protests send a clear message. For the world voting this year, these events impact confidence and trade policies affecting economic growth. The predominant concern is the potential growth of protectionism versus globalization, keeping the world on edge for most of the year.

Inflation expectations

By June, the world will gain a clearer view of the inflation conundrum and its unfolding dynamics. The shocks from Middle East tensions have compelled businesses to reroute their products around the Cape of Hope in South Africa, placing stress on supply chains, but oil has yet to spike beyond $80 per barrel.

Thus far, the conflicts have added complexity to the recovery but not derailed it.

The growth outlook appears to be on the lower side of the 50-year average, with the US anticipating a growth rate of 2.8%, compared to its 50-year average of 3.20%. Globally, as per the IMF’s publication, growth is estimated to be 2.9%, below the 50-year average of 3.47%. The signs of increased efficiency from AI, gradual employment cuts, and the resilience of economies suggest they will weather these headwinds.

How to navigate the year ahead

With the return of interest rates and the reactivation of bond markets, diversification is the key strategy The high levels in cash money markets suggest an opportune time to enter these assets throughout the year.

While semiconductor and big tech stocks may appear overvalued in the share price matrix, their healthy balance sheets and long-term fair value estimates present positive returns for investors. Amidst volatility, it is essential to consider future disruption themes related to aging populations and climate change in investment strategies.

Rebecca Ellis is Family office advisor based Geneva, Switzerland| Contact-re@aktspartners.ch

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com