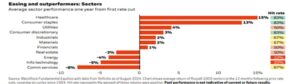

…Interest rate changes significantly shape returns and asset allocation strategies. Cuts in rates have historically benefited equity markets and certain sectors

By Rebecca Ellis

SAT OCT 12 2024-theGBJournal| In the last week of September, China surprised markets with a significant round of quantitative easing, providing a welcome boost to both Chinese and global markets.

Optimism seemed set to continue, but with the approach of the U.S. elections, uncertainties have begun to resurface.

While October holds potential for gains, September may have been the calm before the storm. Geopolitical tensions, including Iranian missile strikes, have taken centre stage, causing markets to dip slightly.

Rising tensions and labour strikes at U.S. ports are adding pressure, particularly on consumer spending ahead of the holiday season.

Although inflation and U.S. jobs reports are neither overly negative nor positive, there’s a growing sense of caution among market participants.

Despite these factors, the expected surge in oil prices and the usual “risk-off” behaviour hasn’t materialized, leaving the market in uncertain waters—caught between bullish and bearish sentiment, with an air of irrationality.

In such volatile times, the best strategy is to take a fundamental, long-term view of the market. We suggest the following:

1. Shift in Interest Rate Cycle

Interest rate changes significantly shape returns and asset allocation strategies. Cuts in rates have historically benefited equity markets and certain sectors, as highlighted in the below research from Blackrock.

Action: Focus on aligning thematic investments with interest rate shifts. This can create opportunities similar to quantitative easing, positioning sectors like ETFs or direct equity holdings in healthcare and consumer staples for growth.

2. Impact of U.S. Elections

Election outcomes influence short-term market direction, creating volatility. But not all volatility is negative—it often brings opportunities.

Action: Use this period of uncertainty to evaluate and add undervalued themes not yet included in your portfolio. Align your strategy with these changing conditions to seize potential gains.

By staying focused on long-term thematic trends and adapting to shifts in interest rates, you can leverage volatility to build a strong portfolio. The healthcare, renewable/green Energy and consumer staples sectors, in particular, may emerge as strong performers as we move into the year-end. This strategic approach can provide the boost your portfolio needs heading into the next market cycle.

Note| We’ve transitioned from a monthly to a quarterly newsletter edition, and I hope you’ll continue to follow our updates, along with myself and the team here in Switzerland.

Rebecca Ellis, ARIF Swiss Client Advisor based in Geneva, Switzerland

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com