…Low consumer savings can be indicative of various economic and financial challenges, both on an individual and a macroeconomic level

…Low consumer savings can have a negative impact on overall economic growth.

By Rebecca Ellis and Martin de Sa Pinto

SUN, OCT 01 2023-theGBJournal |September is statistically one of the worst performing months of the year, and in 2023, we have not escaped the drama.

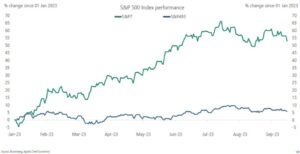

Over the last two weeks tech mega caps, which have been driving the bull run of 2023 have corrected by 10%. This year, we spoke about the market as split into two camps.

Firstly, let’s consider why the markets have defied gravity to date.

YTD the S&P is up 16.7% yet the growth has come from the top 7 stocks which have grown more than 50% whereas the rest of the S&P equities are up 4.9%

This illustrates that the optimism over AI has helped fuel a strong bounce back from 2022 when the market was -19.88%.

What are the fundamental drivers for the US economy to avoid a recession?

The US economy relies heavily on consumer spending. Currently, the unemployment rate remains at an all time low. The 50% optimist club, which include big analyst names such as Bank of America chief economist Michael Gapen, feels that it is possible to come through a higher inflation period and higher interest rates as the is a resilient job market will enable consumers to get through this challenging time

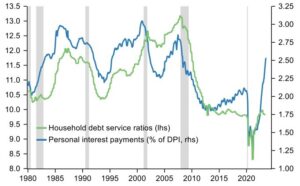

For a recession, there are a number of key elements to consider beyond the employment picture. One of thesis consumer savings. The trends show a worrying picture, which has deteriorated heavily over the last quarter. Let’s take a look at a few measures.

Household in the US are servicing more debt

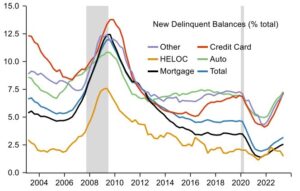

Delinquencies are on the rise

Low consumer savings can be indicative of various economic and financial challenges, both on an individual and a macroeconomic level. Here are some common trends that we have seen in the past with low consumer savings:

Increased Debt Levels: When savings are low, individuals are more likely to rely on credit cards, loans, and other forms of debt to cover their expenses. This can lead to higher levels of personal debt, including credit card debt and student loans.

Financial Stress and vulnerability to Financial Shocks: Low savings often result in financial stress and anxiety among individuals and families. People may struggle to meet their basic needs and are more vulnerable to unexpected expenses or emergencies. They may have to resort to high-interest loans or other means to cover these unexpected costs.

Limited Economic Growth: Low consumer savings can have a negative impact on overall economic growth. When people are not saving, there is less money available for investment, which can slow down economic activity.

Decreased Consumer Spending: Low savings may lead to cautious consumer behaviour, causing people to cut back on discretionary spending. This reduction in consumer spending can negatively affect businesses and economic growth.

Increased Social Safety Net Dependency: When people have insufficient savings to cover their basic needs, they may rely more on social safety net programs, such as unemployment benefits or food assistance, placing additional strain on government resources.

Which camp is most likely to be right?

From the data we can see that the optimists may not be right on this occasion. Past events are not necessarily a guide for the future, but when a recession has hit after savings have been depleted, we must act with caution

How should an investor act?

Take profits in any upswings to grow the war chest for a spending spree on financial securities if a recession happens

Hold equities with a strong balance sheet and that pays out reliable dividends

Gain interest from cash deposit whilst waiting for a downturn

Be patient and focus on a plan rather than the emotion or noise of the moment.

It is always hard to see a portfolio fall even if you have taken profits and cut a portfolio. Portfolios need active management which does mean remaining invested. however, these downturns are an opportunity to gain some bargain for the long term. Give us a call to help develop a strategy and action plan for when this eventually happens.

Rebecca Ellis, Family office advisor based in Geneva, Switzerland| www.aktspartners.ch

Co-author Martin de Sa Pinto, Martin de Sa Pinto Research

Twitter(X)-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com