By Charlie Robertson

TUE, DEC 05 2023-theGBJournal| The new central bank governor, who arrived with a punchy 100bp rate hike at his first meeting, has now doubled that with a surprise 200bp hike in today’s meeting, pushing interest rates to 12.5%.

What’s interested me these past few years is how Kenya has managed a depreciation of the currency, from roughly 20% overvalued a few years ago to a little cheap right now.

It was done slowly, in a very managed way, and while that meant we saw FX shortages (as we’ve also had in Egypt, Nigeria and Angola), it did have the advantage of avoiding shocks.

My working assumption has been that the authorities wanted to get the currency to about 5-10% cheap (based on my Real Effective Exchange Rate model) – to help improve the current account and ensure they can meet their forthcoming external debt obligations.

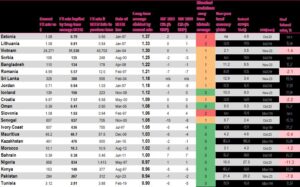

In the table below … it’s the column in the middle (Long-term average divided by current rate) … the KES is 0.96 on this .. which means 4% cheap.

I’d guess the CBK is.. 1) responding to inflationary pressures from that depreciation and 2) perhaps calling time on the depreciation trend.

I’d still forecast we get to 5-10% cheap in real terms – and that’s a level the CBK should be comfortable with.

Today’s interest rate hike helps ensure some of the highest real interest rates in Africa – which is again helpful in containing inflation. It’s also helpful in reassuring foreign investors about their commitment to macro stability.

Charlie Robertson is Head of Macro Strategy, FIM Partners UK Ltd

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com