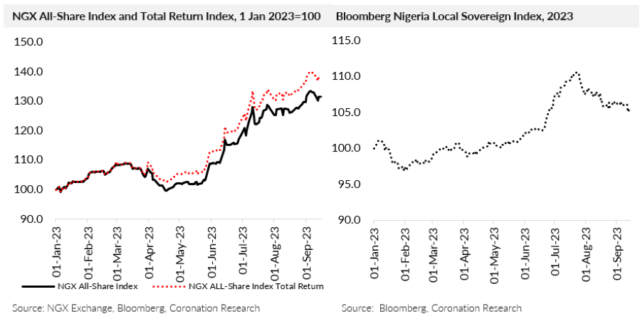

WED, SEPT 20 2023-theGBJournal |The equity market is confounding sceptics with a rise of 31.5% year-to-date while the total return (including the effects of reinvesting dividends) is 38.3%.

At the beginning of the year a 1-year T-bill yielded 5.35% pa and a 10-year FGN Nairadenominated bond yielded 13.36%, so an investor who chose to take equities has done much better, year-to-date, than a fixed-income investor.

An index of long-dated FGN Naira-denominated bonds has returned 4.86% year-to-date. As market interest rates have moved upwards this year (by about 120 basis points) the mark-to-market value of bonds has fallen, offsetting some of the gains delivered by coupons.

We thought that 2023 would be another good year for equities, given that the prospect for earnings growth among the top stocks was about as much as the appreciation of the market during the previous year (2022).

In other words, the market was no more expensive than it had been a year earlier, and it had the potential to perform again.

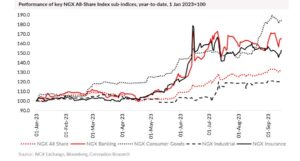

The easiest way to explain 2023’s equity market performance, which indeed has exceeded our expectations, is to break it down into sectors. Each sector has responded to either a government reform, a change in economic fundamentals, or corporate action.

The bank sector has been a star performer, with the NGX Banking Index up 65.5% year-to-date.

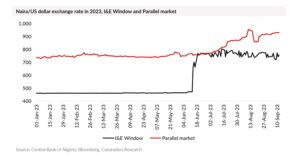

The immediate cause was the liberalisation of the foreign exchange market in June (though, some canny investors were already buying bank stocks during May) and the subsequent devaluation of the Naira/US dollar rate in the I&E Window.

Many banks have substantial long US dollar positions and will record significant revaluation gains when they report results in Naira.

And they are now able to trade in foreign exchange markets in ways that were closed to them previously.

These factors, to a large extent, explain the rally.

The abolition of fuel subsidy, announced during President Bola Tinubu’s inaugural address at the end of May, has also profoundly affected the equity market, as fuel marketers are no longer constrained by the margin imposed on them by the fuel pricing template.

The index of Oil & Gas stocks is up 98.7% year-to-date.

The insurance sector is also a beneficiary of currency devaluation as many insurance companies have net long positions in US dollars and, like many banks, will be able to report revaluation gains. Individual companies have also reported strong results. The NGX Insurance Index is up 52.8% year-to-date.

The most perplexing performance this year comes from the consumer sector. After all, there can be no doubt that with inflation at 25.80% per annum and food inflation at 29.34% pa (data for August), the consumer is under pressure.

The prices of several brewing stocks are down this year, with Nigerian Breweries down by a marginal 0.1%, International Breweries down by 5.3% and Guinness Nigeria down by 6.2% year-to-date (as of last Friday).

Yet the shares of several food and consumer products companies have gained hugely, with BUA Foods up 72.7% and PZ Cussons Nigeria up 184.6% year-to-date.

This appears to be the result of a combination of corporate action and a rebound in earnings. BUA Foods has clearly established itself as a presence in food manufacturing and we see the recently-announced merger of the listed Dangote Sugar, the listed Nascon and the unlisted Dangote Salt as a response to this.

Shares in Dangote Sugar are up 255.1% year-to-date. Meanwhile PZ Cussons Nigeria has reported both a rebound in earnings and announced a buyout of shares by its parent company (subject to ratification by the Securities and Exchange Commission). PZ Cussons Nigeria shares are up by 184.6% year-to-date.

Prospects for Q4 2023

These different factors add up to a remarkable year for NGX Exchange-listed equities, so far. What about the rest of the year? We think that the largest gains in the bank

sector are behind us.

And, overall, the market has done well so we would not be surprised to encounter profit-taking the in months ahead. But that profit-taking may not be heavy because institutional investors, in particular Nigerian pension funds appear to be underweight in Nigerian equities.

So, it is possible that they will correct this by building positions in the major stocks if prices correct (and if sufficient volumes of stock are available for sale).

After all, Nigerian institutional investors cannot fail to notice that the NGX All-Share Index has provided a significant return since the beginning of 2020, with a price return of 151.1% and a total return or 219.9% (by reinvesting gross dividends).

It has easily beaten inflation and out-performed every other Naira-denominated major asset class. 2023 is showing, once again, the case for investing in equities.-With Coronation Research report.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com