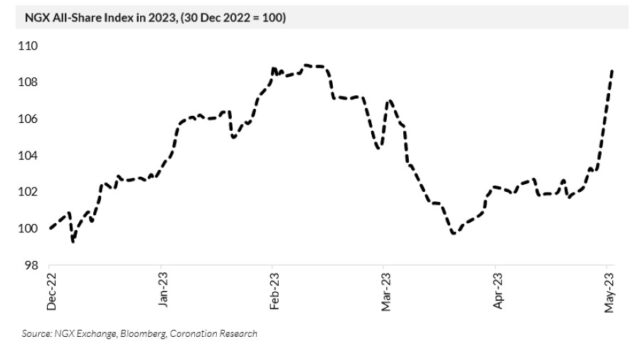

TUE, MAY 31 2023-theGBJournal |The equity market has been electrified by President Bola Ahmed Tinubu’s inaugural address, with a rise in the NGX All-Share Index of 5.23% Tuesday.

Although there is little in the address that was not in the All Progressives Congress’s (APC) presidential manifesto, which has been available for five months, his statement of key pro-investment themes has persuaded the market that reform is on the way.

As we wrote earlier, see Nigerian Weekly Update, Nigerian markets post-election, 7 March 2023, the key potential beneficiaries of increased expenditure on infrastructure, proposed by the APC, are cement companies (our top pick being Dangote Cement) and the principal listed banks.

What has set the market alight is the fact that manifesto pledges which are several months old have made it through into the President’s inaugural address, which was delivered Monday.

The President’s speech has several specific messages for investors, namely to tackle multiple taxation and other anti investment inhibitions, and to ensure that foreign investors are able to repatriate dividends and profits (something which has been difficult in recent years due to low liquidity in the official foreign exchange markets).

The President also applauds the outgoing administration’s plan to phase out the fuel subsidy, pointedly remarking that it has “favoured the rich more than the poor.” Elimination of fuel subsidies, of course, is a key demand of foreign investors, particularly multi-lateral institutions and donors. According to the address, infrastructure, education, healthcare, and jobs will be the beneficiaries of the funds saved.

Next in the Presidential speech comes the issue closest to investors’ hearts, foreign exchange, the President stating: “The Central Bank must work towards a unified exchange rate. This will direct funds away from arbitrage…”

The first step, in our view, might be a merging of the various official exchange rates sanctioned by the CBN: the bigger step would be to float the exchange rate entirely, thereby making the parallel exchange rate redundant.

Whether this will be done is open to question, though we note that there was a small (2.7%) rise in the value of the Naira against the US dollar in the parallel exchange rate market today.

Aside from matters directly affecting markets, the three main points of the address are to: a) use the budget to stimulate the economy in a non-inflationary way; b) use fiscal measures to promote domestic manufacturing; c) increase the level of electricity production. Another key aim is to reduce interest rates.

Without wanting to rain on the parade, it seems prudent to ask whether all these aims are compatible with each other. The most recent print for year-on-year inflation is 22.22% and the CBN’s policy rate is 18.50% while market interest rates are well below this.

So, we would ask how increased budget expenditure will be funded, and if it is not funded then how inflation can be contained at the same time. We would also ask how the phasing out of fuel subsidy can be done without adding to inflation.

We might even model a future in which inflation is rising while interest rates are held low – as was the case from the beginning of 2020 until May 2023 – and ask how the economy will fare under these conditions.

These difficult-to-assess questions make us focus on the two key reforms for investors: fuel subsidy removal and foreign exchange rate unification; and how soon the new administration will get these done.

We expect this equity market rally to last a week or two, but if these two key reforms are achieved, then we would expect it to continue for much longer.-A Coronation Research Market report.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com