TUE, AUGUST 08 2023-theGBJournal |The first seven months of 2023 have seen strong rallies in global equity markets and in the NGX All-Share Index.

Investment conditions have been favourable, even if consensus forecasts for global growth are regularly toned down. What has been remarkable, in our view, is the weakness of commodities.

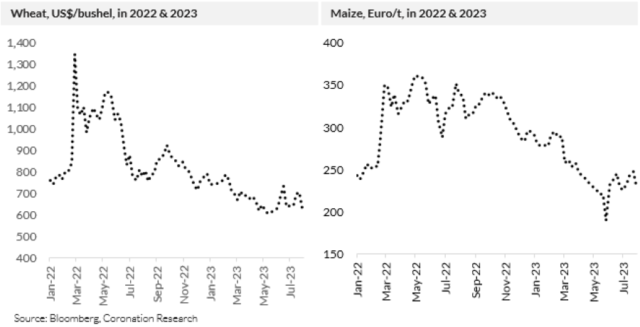

Commodity markets are clearly not looking forward to a bright future in the same way that equity markets are. Starting with the staples of the soft commodity market, wheat and maize, these are having a dull year in 2023, with prices trending down.

These are beneficial movements for Nigeria, which is an importer of wheat and which imports many items whose base lies in maize.

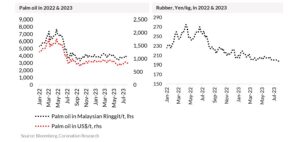

However, the weakness of the soft commodity complex extends to palm oil and rubber, which is unfortunate because Nigeria is a producer of both.

To a degree, Naira depreciation against the US dollar helps Nigerian producers of palm oil and rubber, though this depends whether they are actually exporting their products (in which case the amount of money they receive increases in proportion to the change in the official exchange rate quoted in the I&E Window) or whether they merely substitute products otherwise imported (for which the parallel marketrate was, in all likelihood, already setting the price).

There are some exceptions to this bleak picture, though not many. The international price of cocoa is up 41% year-to-date, for example.

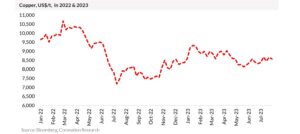

For a measure of how global commodity markets view global growth prospects, we look across to the copper price, and we find copper has been more-or-less flat all year.

The much-discussed stimulus package to reinvigorate Chinse growth does not seem to be having much effect here.

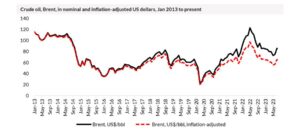

For Nigeria, of course, the most important commodity is crude oil. And oil prices are only slightly down this year, at least in nominal terms.

But should we actually think in nominal terms? After all, oil is priced in US dollars and US dollar inflation has been quite high, reaching at much as 9.1% year-on-year in June 2022 (since when it has trended down).

Granted, we have been thinking of all other commodities in terms of their US dollar nominal prices in this article, but given oil’s peculiar importance to Nigeria perhaps we need to think of its inflation-adjusted price as well.

Adjusting the price of oil for US dollar inflation means that, even though we may think of the price of Brent being US$86.24/bbl, this is not the whole picture.

If we re-base for US dollar inflation, starting in January 2013, then today’s Brent price is an inflation-adjusted US$65.20/bbl, 24% lower than the nominal price.

The difference between the nominal and US dollarinflation-adjusted oil price starts to make a meaningful difference over the past two years (when US inflation picked up).

So the price of Brent crude year-to-date is some 22% lower, inflation-adjusted, than the inflation-adjusted average for 2022. That makes a big difference when it comes to the purchasing power of Nigeria’s petro-dollars.

In conclusion, 2023 so far has been a year of remarkably dull, if not weak, global commodities.

It has benefits (lower import bills for some foodstuffs) and drawbacks. Perhaps the biggest lesson is not to rely on earnings from commodities, crude oil in

particular- Analysis is provide by Coronation Research (Nigeria Weekly update)

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com