THUR, APRIL. 13 2023-theGBJournal |Nigeria has a fast growing tech sector mainly driven by the financial services and the telcos However, a holistic and inclusive approach must be adopted for the entire tech ecosystem, says PwC Nigeria in latest report on Nigeria’s Tech ecosystem ”Growing the Nigerian Technology Ecosystem through the Capital Markets.”

In the report released Wednesday, PwC noted that Nigeria is home to over 400 tech start ups and ranked 61st out of 100 countries worldwide in the start up ecosystem index, Nigeria also ranks number 1 in Africa in terms of venture capital investment destination, leading in both funding and number of equity rounds.

It accounted for 23% of all equity funding and 27% of the total deal count of US$1.2B raised in 202210, portraying the country as the preferred investment destination in Africa.

”Despite these impressive performances, the Nigerian capital market does not optimally reflect the activities of the sector,” PwC said.

”A healthy ecosystem that creates a balance for all subsectors of the technology ecosystem and ensures the optimal flow of required funding to innovate and grow while strengthening governance for long term sustainability is fundamental to enhancing economic growth. Agritech, clean-tech, ed-tech, e-health, recruitment & HR, prop-tech, mobility & logistics etc are equally important and require adequate investments to enhance their capacity to contribute to national and regional development.”

It said the proposed creation of a technology board by the NGX is a laudable initiative and once launched is expected to promote more listings from African technology companies, create an inclusive environment that would serve as a catalyst for further economic advancements whilst deepening the Nigerian capital market.

This is also expected to increase the attractiveness of the Nigerian capital market to tech based companies and position the NGX as a preferred exchange hub in Africa In addition, the tech ecosystem would benefit from improved governance, transparency, talent retention, funding and long term sustainability amongst others by listing on the Nigerian Exchange whilst addressing concerns of these start ups about likely pricing/ risk premiums and ongoing regulatory commitments that would follow.

In December 2022 the Securities and Exchange Commission (SEC) approved the NGX Rules for listing on the Technology Board (The Rules).

The Rules aims to attract technology companies to the capital market with less stringent listing requirements

(compared to other listings boards) and provide Issuers, sponsors, investors and advisors with important information about admissions, listings standards, disclosure and notification requirements for the Technology Board.

Tech-ecosystem and Fintechs in Nigeria: Nigeria is one of the continent’s more established startup ecosystems, with firms like Interswitch dating as far back as 2002. The country has produced five out of seven unicorns in Africa which are; Interswitch, Flutterwave, Opay, Andela, and Esusu.

It is interesting to note that aside from Andela, all other unicorns are in the fintech space.

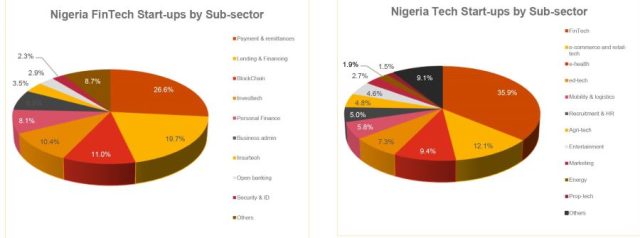

The fintech sub-sector has the biggest share of the number of Nigerian tech start-ups at 36%, with payments and consumer lending being the focus of almost half of the sub-sector. Insufficient banking services (particularly in rural areas), a young population, increasing smartphone usage and regulatory efforts to increase financial inclusion, created advantageous openings for fintechs.

Fintechs have jumped at the chance to provide improved propositions across the value chain to address problems with affordable payments, quick loans, and flexible savings and investments, among others.

Benefits of tech- ecosystem to the Nigerian economy

1-Job-creation and talent development: The tech ecosystem creates jobs as people are still at the center of innovative ideas. The top five companies according to Forbes’ World’s Best Employers Report for 2022, were all technology companies with over a million employees in total.

By 2025, the number of technology based employment created is predicted to expand by almost five times, from 41 million in 2020 to 190 million (Microsoft Stories Asia, 2020). Technology companies can help bridge the unemployment gap in Nigeria by recruiting and developing talents. This increases the quality of the Nigerian working population in terms of being marketable at the global level, contribution to the national economy and also attracting further investments to the country.

2-Stimulation of economic activity and development of more efficient markets: The technology industry has the potential to make a substantial impact, both through the creation of its own economic value and through the development of fresh, creative business models for other sectors. For instance, online payments in the past were quite difficult and this limited the growth of eCommerce in Nigeria.

Fintechs have helped to address business needs for frictionless online payments which have improved payment services. According to the World Economic Forum, conclusions from numerous nations support the favorable impact of technology on economic growth. In emerging nations, for instance, a 10% increase in broadband penetration is linked to a 1.4% boost in GDP growth.

Furthermore, technology increases economic output by enhancing the operating capabilities of organisations, allowing more people to work and use resources more efficiently, thereby optimising the capacity of the economy most of the time. As a result, productivity rises, allowing for larger markets and better organisational decision making.

3-Innovation, new products and services: Technology is making it easier to develop new products and services. It promotes innovation by giving users a greater say in shaping it through collaborative approaches with inventors. The Nigerian economy can benefit from innovative solutions ranging from investing opportunities offered by asset management fintech companies, to remote working abilities to hedge susceptibility to risks such as pandemics, to the creation of smart cities and smart factories through AI for carbon footprint reduction, to data analytics for conservation of resources, the use of blockchain technology for business processes, to the electrification of transportation systems. The benefits to the local economy are boundless.

4-Improved security and enhancement of financial inclusion: Technology companies can help businesses implement better ways to secure business/financial transactions without sacrificing transparency or security. Also, tech-companies like fintechs, can increase access to financial services for people who do not have access to banking services, particularly in rural areas.

Albeit the growing tech-sector in the Nigerian economy and significant private funding secured by African tech start-ups over the years the tech sector is grossly underrepresented in the Nigerian capital market. Out of the 157 companies listed on the Nigerian Exchange (NGX), only 9 companies with a combined market capitalization of circa N11 trillion are technology based companies (excluding traditional banks which have incorporated technology into their operations).

As at 31 December 2022, the top 10 companies by market capitalisation on the NGX were dominated by ICT and Industrial goods companies accounting for c. 70% of the total market capitalisation.

A new era for technology companies in Nigeria’s capital market

Over the years, there have been several initiatives in the Nigerian capital market geared towards promoting

innovation, growth as well as a technology driven capital market.

In January 2021 the Securities and Exchange Commission (SEC) released Rules on Crowdfunding which provided guidelines for the registration and operation of crowdfunding platforms and intermediaries. It also introduced Rules on Robo Advisory Services in August 2021 for the regulation of persons or entities seeking to provide digital advisory services in the Nigerian capital market.

Also, in 2021 the SEC announced the introduction of a Regulatory Incubation (RI) program (the SEC’s regulatory sandbox)alongside Regulatory Incubation guideline.

The RI program was designed to accommodate innovation by fintechs within limits that ensure investor protection whilst also promoting market integrity.

Similarly, in May 2022, the SEC, issued Rules on the Issuance, Offering Platforms, and Custody of Digital Assets covering:

1-Issuance of Digital Assets as Securities;

2-Registration Requirements for Digital Assets Offering Platforms;

3-Registration Requirements for Digital Asset Custodians;

4-Virtual Assets Service Providers; and

5-Digital Assets Exchange respectively

The introduction of these rules are an indication of SEC efforts to encourage and develop innovation in the Nigerian capital market.

In December 2022, the SEC approved the NGX Rules for the Listing on the Technology Board (the Rules).

The Rules were approved as the NGX is set to launch a technology board a specialised platform for the listing

of technology based companies providing these companies with access to finance and visibility.

The Rules provides for less stringent listing conditions (compared to other boards) and takes into consideration the peculiarities of tech based companies.

Africa

In Africa, the tech-ecosystem has experienced impressive growth and is evolving rapidly. There is a high level of optimism about the potential that the continent has to offer by harnessing the strength of its largely young, rapidly growing and technology savvy population.

The number of tech start-ups securing funding in Africa has grown by 1087% from 55 in 2015 to 653 in 2022, while total equity funding raised annually increased by 1673% from US$277 Million to US$4.9 Billion in the same period (Partech,2022).

To accelerate the growth of the tech ecosystem, it is worth noting that the governments in some African countries have created initiatives such as; Program 12J in South Africa that provides tax deductions for investors, the Finance Act 2020 in Nigeria that reduces taxes for start ups, the Nigerian Startup Act 2022 providing a framework for the development of the Nigerian technology and innovation ecosystem, the State Mandated technology training in Ivory Coast, Rwanda’s Private Public partnership with Carnegie Mellon, Egypt’s creation of the largest Fintech accelerator, among others.

Nigeria, South Africa, Kenya, and Egypt are currently the central focus of the African tech ecosystem. These four nations, referred to as the “big four” markets, have received about 73% of the financing in Africa.

Over the years, half of these financing have been in Nigerian start-ups, many of which operate

within the fintech sub-sector in a bid to take advantage of the inadequate banking services in the country. Despite this, many other countries like Tunisia and Ghana, are experiencing increased activity and acquisitions are becoming more common.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.ng| govandbusinessj@gmail.com