WED, DEC 20 2023-theGBJournal|In July Coronation Research examined the low allocation of Nigerian pension funds to equities. They predicted that they would increase their equity allocation, given the high returns of equities over the past few years and the drivers that would propel equities still higher this year

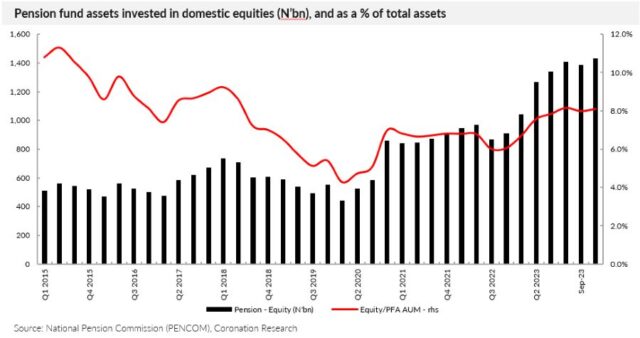

What has happened this year surprises us. Pension funds’ overall allocation to equities has risen (the most recent data shows 8.1% of their total funds allocated to equities) but almost all the increase can be attributed to the rise in the stock market rather than purchases.

At the end of Q1 2023 Nigerian pension funds had a total N1.04 trillion in equites, 6.07% of their total assets. The latest data from the end of October shows them with a total N1.43 trillion in equities (8.1% of total assets). We assume that these are mainly NGX Exchange-listed equities. Between Q1 2023 and the end of October the NGX All-Share Index rose by 27.7%.

So, if the pension funds had neither bought nor sold equities during the intervening seven months, we would expect this total to have increased to N1.33tn by the end of October. They held only N98.5 billion more than this, some N1.43 trillion in total.

And, of that incremental N98.5bn, over half could have come from the effects of receiving dividends and reinvesting them. Perhaps as little as N50.0 billion in additional equity purchases were made. This would have had some effect on driving the market higher but, in the context of a market trading some N7.0 billion per day, not much.

So, why don’t pension funds invest more in equities, given the enormous returns of the NGX All-Share Index over the past four years (2020: 50%, 2021:6%, 2022: 20%, 2023: 41% year-to-date)? One answer is that a large sum of money is tied up in funds for people close to retirement, and these must be allocated to low-risk fixed income funds as opposed to equities.

But the biggest single source of new subscriptions, by number, to Nigerian pension funds are from people under 30 years of age, and their funds can be exposed to equities.

We also think that the way Nigerian pension funds value bonds is a problem. There is an understandable tendency to hold bonds to maturity, but this can lead to not valuing them according to the mark-to-market method.

In a year like 2023, when market interest rates rise and the mark-to-market value of bonds falls, this is important. Knowing the market value of a bonds helps compare its value with that of equities.

Not thinking along market-to-market lines avoids making the comparison and contributes, in our view, to the conservatism of Nigerian pension funds. We now revise our opinion, expressed last July, that Nigerian pension funds are ‘warming to equities’ and instead believe that they are as cold towards equities as they ever have been.

For some categories of Nigerian pension fund holder, this is a pity.-With Coronation Research report

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com