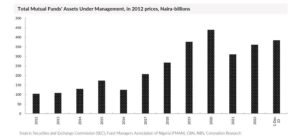

TUE, DEC 12 2023-theGBJournal|The total assets under management (AUM) of Nigeria’s mutual fund industry rose by 46.5% during the first 11 months of this year, according to data from the Securities and Exchange Commission (SEC). This signals a return to growth for the industry as savers become more aware of the value offered by funds.

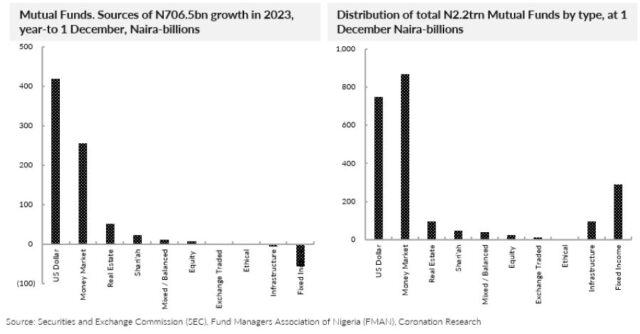

Almost all the growth has come from just two types of fund: US dollar funds and Money Market funds. The growth of Money Market funds is significant because these form the largest portion of the industry (39% of total assets under management) and compete directly with Naira bank deposits for customers’ money.

If people are switching from bank deposits to Money Market funds for their savings, that is a good sign for the fund management industry and a good sign for savers, because Money Market funds tend to yield more than bank deposits.

In our view the growth in Money Market funds is attributable to poor interest rates on bank deposits (particularly inevidence at the beginning of this year); recent rises in market interest rates that increase investors’ returns; the success of fund management companies in making people aware of mutual funds.

We were surprised to find that the value of Fixed Income mutual funds has fallen this year. Only a part of this fall is attributable to the use of mark-to-market accounting (which only some funds use for their published data and which records price losses on bonds when interest rates go up).

Perhaps it is the very unevenness of Fixed Income fund reporting – some funds report average yields while others report mark-to-market positions – that puts people off.

The growth in US dollar funds can be attributed partly to the effects of exchange rates, because the size of US dollar funds are recorded in Naira equivalents and the Naira declined from N460.82/US$1 to N790.82/US$1 between 1 January and 1 December.

That 72% move in the exchange rate expanded the Naira value of US dollar funds, but there was underlying growth of 32% to bring the growth rate over 11 months to 126%.

The industry has now recorded two successive years of real-term growth after the fall in 2021, when low market interest rates drove savers away from Money Market funds. Given recent rises in market interest rates, the prospects for further growth in 2024 look good.-With Coronation Research update

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com