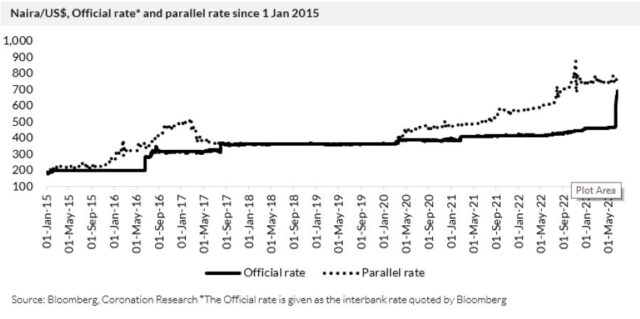

MON, JULY 10 2023-theGBJournal |The past eight years have seen two major realignments of the official Naira/US dollar exchange rate with the parallel market rate.

The first happened in mid-2017 when the two rates converged on N360.0/US$1.

This followed a 31-month period when the parallel market veered away from the official rate.

The second convergence is happening now although, unlike the first, it is less a case of two rates converging towards a mid-point than a case of the official rate weakening in order to adjust to the parallel rate (so far: these are early days).

Today’s realignment comes 38 months after the rates began to diverge in April 2020.

Before we look at the investment implications of currency realignment in 2023, consider that the official Naira/US$ rate and the parallel market rate have been out of step with each other for 69 months during the 101 months since the beginning of 2015.

For two-thirds of the time Nigerian households, businesses, and investors have been contending with dual exchange rates.

The average excess Naira price for US dollars in the parallel market over those 69 months was 34.9%, reaching as high as 96.4% at one point. By contrast, the period of alignment between the two rates was a relatively short 32 months.

Periods of currency realignment are special ones for investors.

There are bound to be opportunities. It makes sense to look back to 2017, which was a good year for investors as a large dose of orthodoxy was restored to monetary and foreign exchange policy and investment gains were made.

There are lessons from 2017 to apply to 2023, but we also think there are important differences.

An historic moment

For at least a decade Nigeria’s multilateral financing partners have consistently called for three key reforms: removal of fuel subsidies; unification of Naira/ US$ exchange rates (to be achieved through a free float of the Naira); power sector reform.

The World Bank (WB), the International Monetary Fund (IMF) and many other development agencies and donor nations have made these demands, and until now they have been disappointed.

It can be argued that Nigeria’s reluctance to enact these reforms resulted in a low level of investment by multilateral and public sector bodies (certainly in comparison with the packages made available to some other emerging markets).

And it cannot be denied that foreign direct investment has fallen over many years. So, now that two key reforms have been enacted (and reforms to the power sector have already been announced), what is stopping these institutions from engaging with Nigeria again? There appears to be no better time to support the country.

The lessons of 2017

The first question we can ask, from the point of view of Naira-denominated investors, is what investment gains were made in 2017, whether in Naira fixed income or in equities. To begin with we look at the equity market.

Recall that there had been three straight years (2014, 2015, 2016) of stock market declines before 2017 as investors first found the market fully-valued (in 2014) and then became uneasy with the dual exchange rate phenomenon (from 2015 onwards).

Then, in 2017 the NGX All-Share Index rose by 42.3%.

There were many reasons for the market’s rise. Market interest rates, expressed as 1-year T-bill rates, declined from 22.9% per annum at the beginning of the year to 16.9% pa by year-end as inflation fell.

The Monetary Policy Rate (MPR) was kept at a constant 14.00%. These were good conditions for investors to switch from T-bills into long-dated FGN bonds and equities.

The Federal Government of Nigeria (FGN) Naira-denominated bond market rallied with the Bloomberg Nigeria Local Sovereign Index rising by 25.7% over the year. ..To be continued tomorrow….

This Special Report is written by Coronation Research and made available to theGBJournal

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com