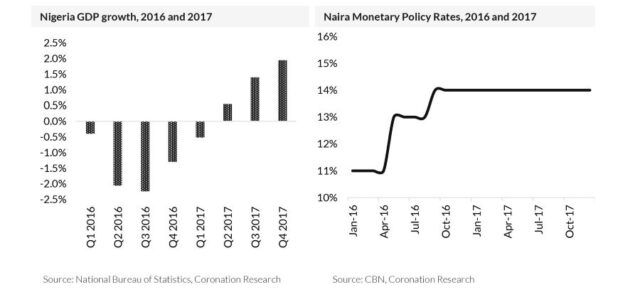

TUE, JULY 11 2023-theGBJournal |The economics of 2017 were very different to those of 2023. A recession, which had started in Q1 2016, came to an end in Q2 2017.

By contrast, and after many years of monetary stimulus, Nigeria has enjoyed many quarters of continuous growth as we approach the second half of 2023.

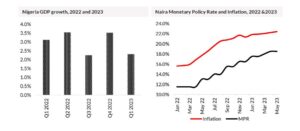

And, as noted above, the Monetary Policy Rate of the CBN was a constant 14.0% during the year whereas the MPR has been on an upward trajectory for over a year in mid-2023 and currently stands at 18.50%.

As we note later in this report, we do not yet know this administration’s overall strategy for domestic Naira interest rates, though we will likely know more after the next regular meeting the Monetary Policy Council (MPC) of the Central Bank of Nigeria (CBN) on the 24th and 25th of this month.

The new administration has expressed its intent to tilt towards a lower policy rate environment. The set goal is a 9.0% Monetary Policy Rate versus the current 18.5%.

The intention is that low interest rates would stimulate demand for credit.

Will foreign investors return in 2023?

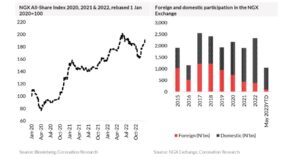

The next question is: “What sort of investors were attracted to the stock market in 2017?” As noted above, Nigerian investors, who in those days could earn risk-free returns in T-bills above the rate of inflation, were attracted because nominal T-bill yields were declining and there was an incentive to take equity risk (end of recession, end of dual foreign exchange rates).

Foreign investors were also attracted. Even though they had experienced difficulties repatriating funds during 2016, there were enough dedicated Sub-Sahara Africa funds (located in the UK, South Africa, US, Europe and Singapore) willing to give the Nigerian stock market a second chance, and they invested.

While 2017 was a good year for returns they were disappointed in 2018 and in 2019 when the stock market fell again. The profile of investors in Nigeria’s domestic capital markets in 2023 is very different from what it was then.

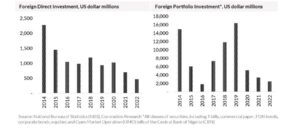

Foreign Portfolio investment (FPI) has declined over successive years and makes up a small proportion of the investment pool.

Foreign portfolio investors participated in the equity market rally of 2017 and other classes of foreign portfolio investor (hedge funds and local currency debt funds) participated in the Open Market Operation (OM0) bill market and the T-bill market in 2018 and 2019 (the combination of Naira interest rates and FX hedging through forward rate agreements was remunerative).

After 2019 foreign portfolio investment declined significantly as Naira market interest rates crashed.

Therefore, while we are sure that there are foreign investors taking part in the equity market this year, we doubt they will be the kind of driving force they once were although it is important to note that foreign participation in the equity market rose significantly in May and is likely to have risen further in June.

Will Nigerian pensions take more equities?

Just as important as foreign investors are domestic pension funds, which together manage some N15.6 trillion (in theory equivalent to 48.4% of the current market capitalisation of the NGX Exchange). Pension funds have historically low percentage allocations to equity.

This is despite the positive returns recorded by the NGX All-Share Index in the successive years 2020, 2021 and 2022. We would expect domestic pension funds to increase equity allocations this year, and together with domestic mutual funds and retail investors we expect them to be the major participants in the stock market going forward. To be continued tomorrow…

This Special Report is written by Coronation Research and made available to theGBJournal

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com