TUE, MAY 23 2023-theGBJournal |For the past 15 months the world’s economies have been contending with high inflation.

Monetary authorities have raised policy rates and market interest rates have moved sharply upwards, giving opportunities to savers.

By and large, initiatives to combat inflation in major economies are meeting with success, with markets looking ahead to a period, during the second half of this year, when policy rates in the US and the European Union are likely to level off or even fall.

What does this mean for the world’s largest economies and their equity markets, and for global commodity markets? The answer to the last question has important implications for Nigeria.

There is a distinct pattern to the global effort to contain inflation. First, high interest rates act as a brake on economic activity.

The US grew by 1.1% year-on-year in the first quarter of 2023, far slower than the 2.6% year-on-year growth during the preceding quarter (and below forecasts of 2.0% growth).

We are seeing successive downgrades to forecasts of global economic growth for 2023. The impact of elevated US dollar interest rates on the banking sector (consider the two bank collapses in the US and the collapse of Credit Suisse in Europe during March) raises questions over the health of developed economies. Credit growth is constrained and slow economic growth is a given.

Equity markets, by contrast, are buoyant. Equity markets are good at anticipating economic recovery six-to-nine months ahead.

In addition, restructuring in the US technology sector has been swift (we recall the announcement of deep job cuts at the beginning of this year) and some businesses, such a Meta, have reported outstandingly good first-quarter results.

The S&P500 Index of US stocks is up 9.62% year-to-date and the Nasdaq Composite Index of technology stocks is up 21.10% year-to-date. In Europe the Eurostoxx50 Index is up 15.86% year-to-date.

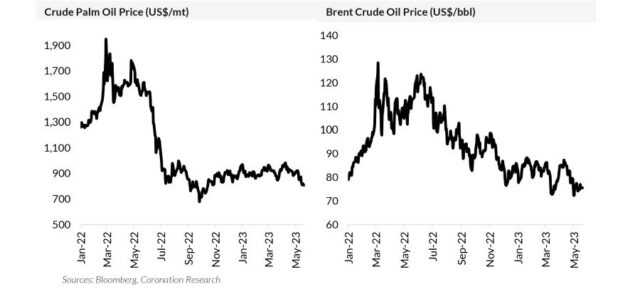

This leave commodities trailing. Commodities are reacting to concerns over global growth and not factoring in the probability of an uptick in economic activity later in the year.

This is a consistent picture across hard commodities (for example, copper and oil) and soft commodities (for example, wheat, maize, palm oil and rubber).

For the oil markets this need not have been the case, because part of global oil production belongs to a cartel, the Organization of the Petroleum Exporting Countries (OPEC) and its ally Russia (OPEC+), and the cartel could have cut production in order to keep prices high.

Some two months ago OPEC+ did announce an output cut, yet this failed to lift prices for more than a week or two.

The likely reason for this was given in a recent report from the International Energy

Administration (IEA) which details how, during April, Russia was pumping more, not less, oil than before.

According to the IEA Russia pumped 8.3 million barrels per day (mbpd) in April, compared with an average of 7.7mbpd in 2022. 80% of these barrels are destined for either China or India.

For Nigeria there are several knock-on effects. The current 2023 government budget benchmarks a Brent crude oil price of US$75.00/bbl. Last year this would have been easily exceeded: this year the actual price is much closer to the benchmark.

This has negative implications for the flow of foreign exchange into the Central Bank of Nigeria (CBN) and for government revenues.

Soft commodity weakness is also significant. Nigerian farmers are able to sell tubers for starch production when the prices of alternatives are high, but when international maize prices (and prices of other starch sources) are low it makes sense for Nigerian food manufacturers to buy imported starch.

Our understanding is that, in some parts of the market, import prices are sufficiently low to compete with local production.

Similarly, international palm oil and rubber prices are low, negatively impacting the fortunes of indigenous Nigerian producers. The international equity markets may be strong but a recovery in the commodity markets that matter for Nigeria appears to be some way off.

This report is written by Coronation Research analysts

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com