MAY 15, 2018 – Investor confidence in South Africa’s new administration will be tested as the country sells its first Eurobonds under President Cyril Ramaphosa at a time when emerging-market currencies and debt are under pressure amid rising U.S. rates and geopolitical tensions.

That may not be enough to lower the country’s dollar-borrowing costs. The premium investors demand to hold South Africa’s dollar debt rather than U.S. Treasuries has climbed 25 basis points since the beginning of February, and widened eight points on Tuesday to 267, more than the two-point increase for the emerging-market average. Pricing on the new Eurobonds will depend on how investors weigh the improved fundamentals against an aversion for risk.

South Africa had budgeted to sell $3 billion of international bonds this fiscal year, according to Treasury documents. External debt accounts for less than 10 percent of the country’s overall borrowing and just 4.6 percent of gross domestic product, according to a prospectus for the Eurobonds filed with the Securities and Exchange Commission.

While the new government has put in place programs to stimulate the economy and stabilize debt, the success of those measures depends on Ramaphosa’s ability to implement them against political opposition from within and outside the ruling African National Congress, the prospectus states.

“There can be no assurance that such initiatives will achieve or maintain the necessary political support in the short or long term,” the prospectus states. “The political environment in South Africa has remained challenging with continued tensions between populist and reform-oriented politicians.”

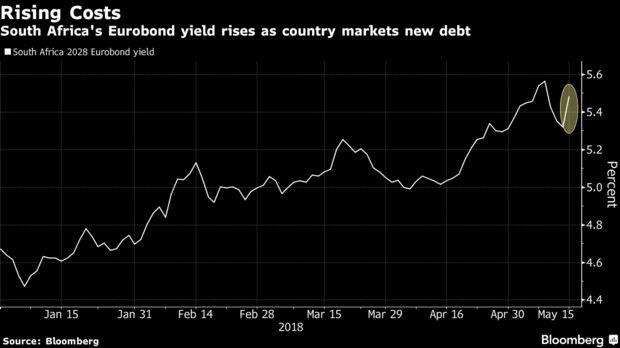

South Africa last issued Eurobonds in September, when it sold $2.5 billion of 10- and 30-year notes. Yields on the former rose nine basis points to 5.48 percent by 11:21 a.m. in Johannesburg, while the longer-dated securities traded at 6.05 percent. South African dollar bonds have lost 2.4 percent this year, well below the emerging-market sovereign average loss of 4.3 percent, according to data compiled by Bloomberg.

Deutsche Bank AG, Nedbank Group Ltd., JPMorgan Chase & Co., FirstRand’s Rand Merchant Bank and Standard Bank Group Ltd. are managing Tuesday’s deal.

African governments have been prolific issuers this year. Egypt, Angola, Nigeria, Senegal, Ivory Coast, Ghana and Kenya have raised more than $20 billion in dollar and euro-denominated securities, already a full-year record for the continent.