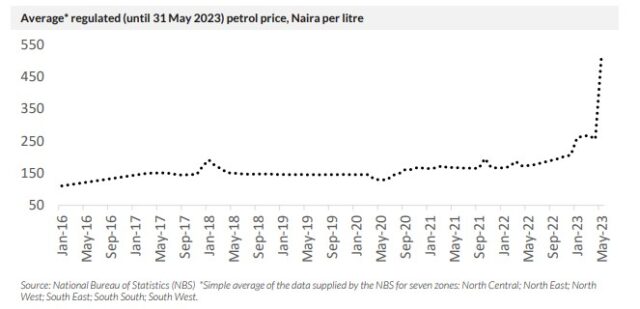

TUE, JUNE 06 2023-theGBJournal |In the middle of last week the price of petrol in Nigeria rose by almost three-fold. This followed the President’s announcement of fuel subsidy removal during his inaugural address on 29 May and the Nigerian National Petroleum Corporation’s (NNPC) publication of market-reflective prices soon afterwards.

According to data released by the NNPC the price of petrol in Lagos, for example, rose from N184/litre (40 US$ cents at the official exchange rate) on 29 May to N488/litre (US$1.05) on 31 May, a rise of 165%.

This is an historic moment because, over the years, multilateral institutions such as the IMF and the World Bank, as well as donor countries have called for three key reforms: fuel subsidy removal; unification of foreign exchange rates; power sector reform. Now one of these has been implemented.

In the government’s 2022 budget the fuel subsidy was N4.0 trillion (US$8.6bn) which swallowed up 40.1% of budgeted aggregate revenues of N9.97 trillion (US$21.4bn). Note that by not subsidising fuel, the Federal Government of Nigeria (FGN) is making a US dollar saving.

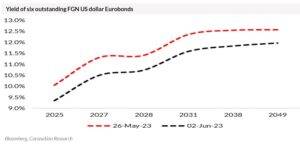

International bond markets have been quick to spot this, with yields of FGN US dollar Eurobonds tightening across the curve immediately after the announcement. The average yield of six traded FGN Eurobonds fell from 11.7% immediately before the announcement to 11.0% at the end of last week. Even then, this does not seem like excessive optimism to us, and we continue to believe that FGN US dollar Eurobonds, especially short-dated ones (with maturities in 2025, 2027 and 2028) represent good value.

Among Nigerian companies we believe the biggest beneficiaries are refiners and petroleum marketing companies. Refining used to involve purchasing oil at an unregulated US dollar price, refining it, and then selling products at subsidised Naira prices – hardly an enticing proposition. To be able to sell products at unregulated prices provides an incentive to refine, in our view. Next, and with the removal of the rigid margin in the NNPC’s petrol pricing formula, petrol marketing companies are able to set their own margins. Shares in petroleum marketing companies continue to rally today.

What are the implications for companies generally? The market is somewhat more sober about this than it was last week when the market rallied by 5.2% in a single day (Tuesday, 30 May). The fact is that individuals, households, small businesses and a swath of economic participants rely on petrol to power their electricity generators and to power their cars.

The cost implications of fuel subsidy removal are unpleasant and analysts are scrambling to assess how much damage to companies’ margins will be done. The key fact is that individuals are paying almost three times as much for fuel as they were a week ago

and are suffering. The consumeris, once again, under pressure.

We also need to assess the possible reaction of foreign investors who may be looking to reinvest in Nigeria. Foreign investors, we believe, will want to see other key reforms (foreign exchange, power sector) to be implemented before returning.

And they will likely demand a period in which to build up trust in the markets, after many disappointments and false dawns over the past decade. The good news is that this administration appears to be in no mood to compromise on reform, having made a bold start, so we remain optimistic.-

-Coronation Research Market Report

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com