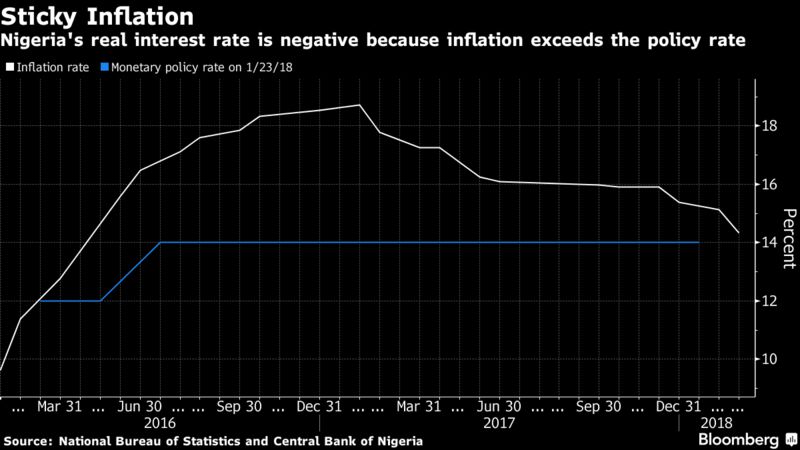

…Central bank has kept rate at a record 14% since July 2016

ABUJA, APRIL 4, 2018 – Nigeria’s Monetary Policy Committee will probably leave interest rates unchanged at its first meeting of the year even though the panel has added five new members since its previous gathering in November.

While inflation slowed to 14.3 percent in February, central bank Governor Godwin Emefiele has said the MPC could loosen policy before July if price growth drops nearer to single digits.

“Underlying inflation, that’s without energy and food prices, has been sticky,” Michael Famoroti, an economist at Lagos-based Vetiva Capital Management Ltd., said by phone.

Policy makers retained the benchmark rate at a record high since July 2016 to help support the naira. While the currency has stabilized at about 360 per dollar and reserves increased, the central bank is wary of foreign-exchange pressures and regularly intervenes in the market to boost liquidity.

“We expect them to hold, and then start signaling policy intention for a cut by reducing frequency or rates of open market operation instruments” such as Treasury bill sales, Famoroti said.

Nigeria’s current-account balance has been in surplus for the last five quarters and this should give the central bank leeway to support economic growth rather than the naira, according to Bloomberg Economics economist Mark Bohlund. However, that window may be closing as the recovery in domestic demand could erode the surplus, he said in a note.