By Rebecca Ellis

SUN. 02 APRIL 2023-theGBJournal | Since our last update following the closure of SVB Bank, the market mood has darkened as fears of a banking crisis took hold. While such fears abated somewhat this week, the crisis did not end there. Let’s take a look at what happened.

SVB failure to manage risk of declines in long-dated Treasury prices triggered by interest rate rises, meaning higher-than expected client withdrawals could force them to sell these securities at below their par value, crystallising losses and precipitating a liquidity squeeze.

In the case of Credit-Suisse, a far larger and supposedly more diversified bank, a series of scandals and regulatory fines had pushed the share price steadily lower over several years, while losses began to mount at the once highly profitable behemoth. As the bank scrambled to reorganise its business, large scale client withdrawals, which exceeded $120 billion in the fourth quarter of 2022 alone, put the share price under almost unbearable strain.

As fears spread that the collapse of minor US institutions Silvergate, Silicon Valley Bank and Signature would further pressure the weakened Credit Suisse, the Swiss National Bank stepped in with the promise of almost $60 billion to shore up liquidity.

But to no avail. Client withdrawals from the bank blew through that figure within days, forcing the panicked Credit Suisse board to agree to a knock-down sale to its fiercest domestic rival, UBS.

This series of events has clearly darkened the mood of global markets. The collapse of a major bank rarely heralds anything good, particularly when coupled with an inverted yield curve. As March closes, two-year Treasuries may be heading for their steepest monthly increase since 2008, and are now yielding a higher return than their theoretically riskier 10-year version.

The importance of this is that funding is more expensive short term which means the following

-Businesses will have to allocate more funds to pay for short-term borrowing such as overdrafts and bridging loans

-Consumers will have to pay more for home financing and credit card debt. For example, if you are refinancing a home loan you may be locked into higher interest rates going forward.

-Economy – The San Francisco Fed has shown in their study for the period 1955-2018 that an inverted yield curve tends to herald a recession, which typically arrives between six and 24 months after the inversion.

While some commentators feel the sharp market decline of 2022 may have taken us through the worst of an expected recession, the data now emerging indicates that the real recession is yet to arrive.

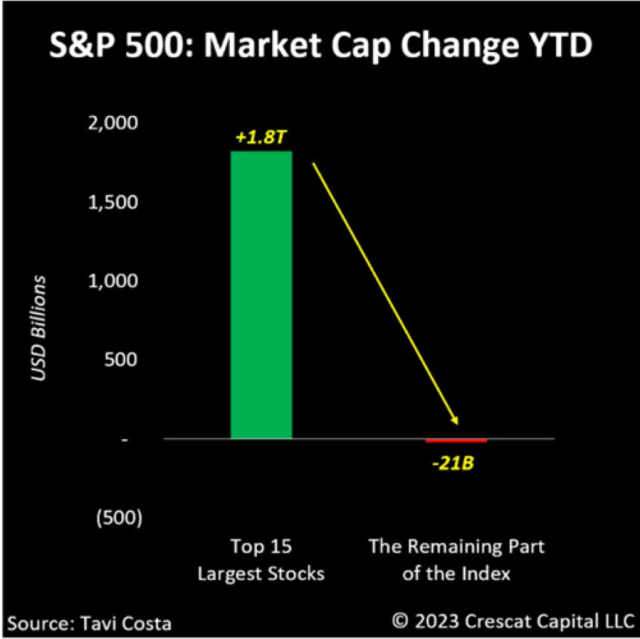

Firstly, from numerous technical data indications offered by, for example, small caps and high yield markets, the recovery looks temporary. This evaluation is reinforced by the interesting observation that the recovery over the last weeks has been driven by the top 15% market cap stocks of the US S&P 500 and not the broader market. This does not suggest that a bull market is underway.

Secondly, the graph below below shows another important fact about the inversion of this yield curve. It shows it is a precursor for a recession which has been consistent signal since 1945 and typically, takes place once the inversion reverses.

Like with everything in life, there are always positives and opportunities to be found.

This is not the time to throw in the towel. Furthermore, with this information, investors should position their portfolios with care and use upwards swings like we saw 29 March to rebalance their risk. In spite of stormy markets, opportunities remain.

Rebecca Ellis is Family office advisor| Co-author Martin de Sa Pinto, Martin de Sa Pinto Research

If you have any comments or would like to have a chat, please do not hesitate to get in touch| Contact:re@aktspartners.ch

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.ng| govandbusinessj@gmail.com