THUR, APRIL. 13 2023-theGBJournal | This year market interest rates have been volatile, and at the moment savers have much better opportunities than they had at the beginning of the year.

The explanation for these big swings in rates lies in the banknote replacement policy of the Central Bank of Nigeria (CBN), in Coronation’s view, and the overruling of that policy by the Supreme Court in March.

The CBN’s policy to withdraw old Naira bank notes and reissue new ones had one clear characteristic, namely lack of new banknotes. This meant long queues at ATMs, and an observable strain on the inter-bank payment system as cashless customers attempted to transact with each other (clearly, the infrastructure cannot cope with the cashless society just yet).

The other, slightly less obvious, effect was that commercial banks were suddenly liquid with their customers’ cash. When they bid at T-bill auctions they had plenty of money to spend.

This depressed rates all the way from January through to mid-March, with the 1-year T-bill rating trending as low at 3.78%.

Next, and following the ruling of the Supreme Court, the CBN instructed banks to issue old notes again. This reversed the trend in their liquidity and, with less money to spend at T-bill and FGN bond actions, short-term rates moved sharply upwards again. This was also reflected in the indicative rates offered by banks to financial institutions for 90-day deposits.

Does this mean that today’s savings rates are exceptionally good, and that savers need to take advantage of them now? It is difficult to say, because we do not know the extent to which old banknotes have been reissued and the extent to which further reissues of banknotes are set to create illiquid conditions at banks, which could force rates upwards again.

What is certain is that these rates are far better than what has been available for many months, although far short of the rate of inflation at 21.91% year-on-year.

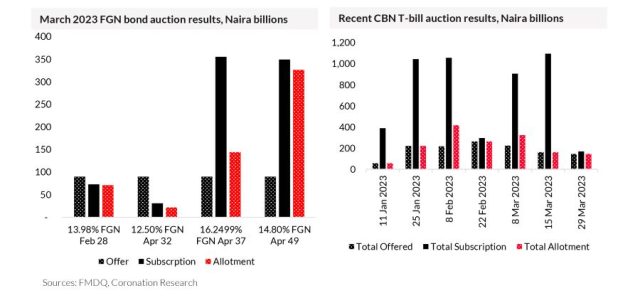

Note that the Debt Management Office (DMO), which auctions new FGN bonds, and the CBN, which auctions T-bills, have been behaving very differently from one another this year. The DMO has tended to sell at auction amounts of FGN bonds close to what bidders have subscribed.

This means it has come close to meeting investor demand for bonds, with the result that bond yields have not moved much. By contrast, the CBN has been selling amounts of T-bills close to what it offers, with allotments not reflecting the huge sums that were being bid during January, February, and early March.

The result was a crash in T-bill rates while FGN bond rates did not change much at this time. Now the sums being bid at T-bill auctions are much less than before (see the results for the 29 March auction in the chart, above) and T-bill rates have risen.-With Coronation Research report.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.ng| govandbusinessj@gmail.com