By Charlie Robertson

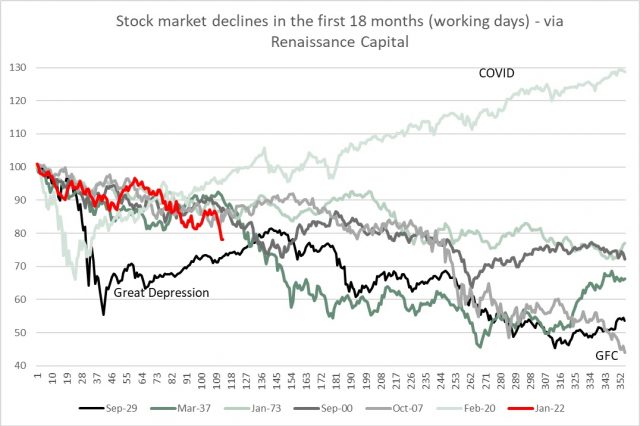

WED, 15 JUNE, 2022-theGBJournal| After the past few days, I couldn’t help but update this chart, if SPX drops to 3,500, we (the red line) would dip under the black line of the Great Depression 1929 Crash. That came after US markets had also reached extreme highs .. it only became a Great Depression because it didn’t rebound in 1930, or 31 or 32. Not saying we’re anything like that now. But I am a little surprised we are as weak as this, so quickly.

Assuming a recession comes, the bottom for the market could be early 2023.

I was asked earlier today why market declines matter for the person on the street- and one way they matter is when they close the markets to low-income Eurobond issuers.

While Sri Lanka has already defaulted, market pricing suggests Ghana could not refinance even it wanted to. It would probably be difficult for Pakistan too. I suspect Egypt could issue as they have Gulf support and an IMF deal being worked on, but I wouldn’t recommend they do this (their interest bill is high enough already).

Looking tough for Nigeria too – which explains their cancellation of a planned $950m issue earlier in June.

Tunisia too is priced to default. It – like Pakistan – is struggling to get agreement with the IMF, with the labour union rejecting IMF conditions. Kenya Eurobond pricing has improved in the past week or two – despite talk of dollar shortages and a widening spread on the currency (KES112-121). The CB governor assured the press this week that the very predictable depreciation of the KES was a free float of the currency as recommended by the IMF.

Meanwhile in countries with much less debt, like Bangladesh, the currency deprecation against the US dollar is at least removing the excessive appreciation of the BDT vs the Euro.

Overall, we have weak German IFO expectations, renewed Omicron lockdowns in China, and the Fed probably forced to hike more due to higher than expected inflation – tough times. Perhaps a plunge in oil prices, Chinese success vs Omicron (or giving up on their strategy – unlikely), or surprise good news on US inflation would let us avoid a recession

Within all this, I don’t see any compelling buys. The closest to a buy would be some of that dollar debt in the Frontier space – but the required game-changer to get them higher would be either the Fed giving up on so many rate hikes (not going to happen soon) or the IMF/G20 coming to the rescue with a big bail-out support package. The World Bank has begun to talk about the risks of a wider debt crisis. But 2008/09 and 2020/21 show us such a package isn’t at all likely in coming weeks, and probably not months.

Eyeballing the EM FX table, and nothing jumps out at me. Other than Turkey looking cheap, but that doesn’t help the C/A because such deeply negative real rates are pulling in imports (as Hakan Kara noted on twitter yesterday – that’s not just due to energy prices). Erdogan is trying to make Turkey look more like stereotypical Argentina than Argentina itself.

Sofya’s sticking with the RUB85/$ end-year view, but wouldn’t be surprised by RUB70-75/$.

Nor in Frontier FX, although we can see why the naira might be depreciating a little in recent days, and why Kenya’s shilling needs to keep depreciating. Pakistan’s rupee has already weakened past my 200/$ end-year forecast (which once looked bearish) so I’ve shifted that to 215/$ as an interim measure. Sofya has strengthened her KZT view to KZT445/$ – her email is sdonets@rencap.com if you don’t get her CIS+ updates.

CONCLUSION: It’s tough out there, and previous US stock market falls imply it might be tough until at least early 2023, assuming we do get a recession. If inflation hurts the poorest in developed markets, globally, inflation and resultant US rates hikes hits the poorest countries hardest.

Charlie Robertson is Author of the upcoming Time Travelling Economist and Global chief economist, Renaissance Capital

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com