…The Fiscal and Tax Reform Bill also provides the much-needed fiscal framework for taxation in Nigeria, outlining the rules of the game for tax collection and administration.

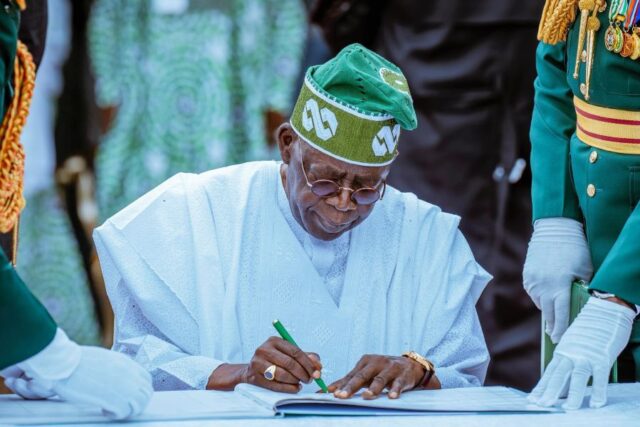

THUR OCT 03 2024-theGBJournal| The Senate President, Godswill Akpabio, read a letter containing four groundbreaking tax reforms bills sent by President Bola Tinubu today-the Fiscal and Tax Reform Bills, for members consideration and passage.

These bills are designed to propel the country’s economic growth and streamline its fiscal institutions.

The Fiscal and Tax Reform Bill also provides the much-needed fiscal framework for taxation in Nigeria, outlining the rules of the game for tax collection and administration.

”The Nigeria tax reforms provides a consolidated fiscal framework for taxation in Nigeria,” the President wrote

President Tinubu told the Senate that the Bill, Nigeria tax administration Bill, provides a clear and concise legal framework for the fair, consistent and efficient administration of all the tax laws to facilitate ease of tax compliance, reduce tax disputes and optimize revenue.

The Bill contains, first, the Nigerian Revenue Service Establishment Bill, which effectively repeals the Federal Inland Revenue Service Act and establishes the ”Nigeria Revenue Service”, to modernize tax collection and management.

The Nigeria Revenue Service will assess, collect and account for revenue accruable to the Federal Government.

Secondly, the Joint Revenue Board Establishment Bill. This bill will create a tax tribunal and a tax ombudsman, ensuring fairness and transparency in tax disputes arising from revenue administration in Nigeria.

”The proposed tax bills presents substantial benefits to align with my government’s objectives on fiscal reforms and economic growth by enhancing tax payer compliance and strengthen our fiscal institutions,” the President said.

The Presidential Committee on Fiscal Policy and Tax Reforms has already submitted its report to President Tinubu, outlining the roadmap for these reforms.

And, as part of the holistic fiscal policy reform, the Federal Government has gazetted the Deduction of Tax at Source (Withholding Tax) Regulations 2024, offering relief to manufacturers and businesses.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com