…Sellers to continue to price these challenges in the cost of their goods and services.

…Besides, the risk of increased flooding remains like in the past few years. Consequently, food shortages will remain dominant, further pressuring consumer prices.

FRI, DEC 29 2023-theGBJournal|In forecasting Nigeria’s headline inflation rate, various factors that may shape the domestic prices over 2024FY were analysed, which include but are not limited to:

• Higher wages & salaries

• Currency pressures

• Electricity tariff hikes

• Prospects of higher PMS price

• Below-average planting season

Higher wages & salaries: To alleviate the price pressures stemming from the government reforms, President Tinubu, on 01 October, announced N35,000 provisional wage increment for all federal government workers for six months and N25,000 payment to 15 million households for three months, starting in October.

Besides, it is understand that many private companies have also increased workers’ salaries as part of the measures to reduce pressures from high prices. Tying it all together, we believe the preceding will add a layer of pressure on the money supply, which would have a spillover impact on domestic prices.

Currency pressures: Local currency pressures is expected to remain intact in 2024FY, as we do not expect the one-off dollar inflows in the pipeline (USD3.00 billion NNPC-AFREXIM crude repayment loan and USD1.50 billion World Bank budget support facility) to be sufficient to cater for the teeming FX demand.

Thus, on our baseline assumption, the official exchange rate is expected to depreciate to an average of N800.00 – N850.00/USD relative to the monetary authority’s desired level.

Electricity tariffs: Recall that when the electricity distribution companies proposed a 40.0% increase in electricity tariffs in July, the House of Representatives stopped the NERC from implementing the price increase, stating that it was not a convenient time.

In addition, we understand that President Tinubu stated that the NERC should not increase the electricity tariff until the country is able to achieve regular and incremental power supply.

As power supply improves, we expect the NERC to proceed with further electricity tariff hikes in 2024, more so that the cost of electricity production and distribution has increased significantly. Given the expected resistance and social impact, we anticipate only a 20.0% average increase in electricity tariff.

Prospects of higher fuel prices: Given the deregulation of PMS prices, the product has been selling at different prices across the country, with the highest and lowest average retail prices at N665.56/litre and N602.55/litre, respectively, as of September.

While some independent players have been granted licenses to import fuel into the country, we highlight that the NNPC remains the sole PMS importer, given that the other players have limited ability to source FX amidst the lingering local currency challenges.

Besides, we understand that the NNPC has started paying cash to import fuel into the country.

Thus, as crude oil prices increase and local currency depreciates slightly at the official market, we expect queues to build up, with pressures mounting on the

NNPC to raise prices. To find a balance amid these, we anticipate that fuel prices will increase slightly by an average of 5.6%.

Below-average planting season: Gleaning insights from Famine Early Warning System Network (FEWSNET) monthly food security reports, we understand that

planting in Nigeria was below historical averages in 2023FY.

We highlight several reasons responsible for the underwhelming planting season, including intermittent attacks and abductions across the food-producing states, higher fertiliser and other input prices, and prolonged dry spells. Given the positive correlation between planting and harvesting, we expect the 2024FY harvest

season to be limited.

Besides, the risk of increased flooding remains like in the past few years. Consequently, food shortages will remain dominant, further pressuring consumer prices.

Supply chain constraints: Besides the abovementioned factors, it is essential to highlight that the domestic distribution chain is still not robust enough given poor road infrastructure, weak storage systems, epileptic power supply, and vulnerable seedlings.

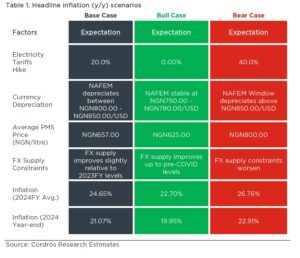

Accordingly, we expect sellers to continue to price these challenges in the cost of their goods and services. Based on the highlighted factors, we modelled three scenarios for the headline inflation in 2024FY: the Base Case, Bull Case and Bear Case.

Analysis provided by Cordros Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com