MARCH 20, 2018 – Crude advanced to a three-week high as the OPEC-led alliance of major oil producers accelerated the timeline for curbing a worldwide supply glut.

Crude in New York has advanced more than 5 percent this year as the oversupply that crushed prices in the 2014-2016 slump began to drain. Record high U.S. crude production coupled with mounting levels of stored supplies in American tanks and terminals forestalled any price breakouts. UBS Group AG said it maintains a negative view on prices because of near-term builds in inventories.

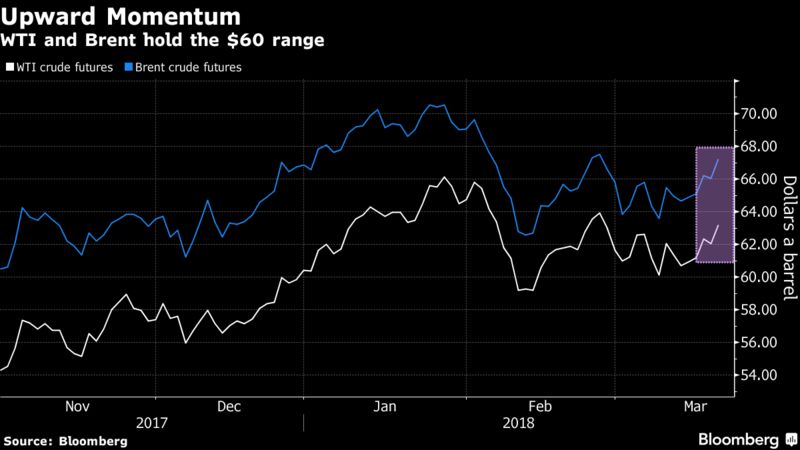

West Texas Intermediate for April delivery, which expires Tuesday, advanced $1.54 to $63.60 a barrel at 11:10 a.m. on the New York Mercantile Exchange, the highest intraday level since Feb. 27. The more-active May futures contract rose $1.20 to $63.33.

Rebalancing Scenario

Brent for May settlement surged $1.26 to $67.31 on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a $3.98 premium to WTI for the same month.

The special committee established to monitor compliance by the nations aligned with Saudi Arabia and Russia to curb supplies said its timeline assumes Libya and Nigeria keep output at February levels and other participants in the deal maintain full adherence, according to the people familiar with the matter who weren’t authorized to discuss it publicly.

In the U.S., crude stockpiles probably expanded by 3.2 million barrels last week, according to a Bloomberg survey ahead of a government report scheduled to be released on Wednesday. Inventories held at the key Cushing, Oklahoma, pipeline hub probably rose by 200,000 barrels last week, a forecast compiled by Bloomberg shows.

The industry-funded American Petroleum Institute will release its weekly inventories data later on Tuesday.