MON 13 DEC, 2021-theGBJournal- Nigerian Exchange Limited (NGX) says the value of Nigeria’s green bonds market has grown to N55.52 billion within 2017 and 2021.

The Chief Executive Officer, NGX, Temi Popoola CFA, disclosed this during the Sustainable Finance Training 2021 hosted by NGX in collaboration with the International Finance Corporation (IFC), while adding that The Exchange is committed to fostering the growth of sustainable financial products which integrate the financial risks and opportunities associated with climate change and other environmental challenges.

Popoola in his opening remarks said Sub-Saharan Africa is the least responsible for global climate change but remains one of the most vulnerable to the risk posed by climate change. Citing the World Meteorological Organization State of the Climate in Africa Report 2020, he stated that the investment in climate adaptation for Sub-Saharan Africa would cost between $30 to $50 billion each year over the next decade, or roughly two to three per cent of GDP.

He revealed that the limited flow of climate finance remains a major issue for the implementation of mitigation and adaptation actions in Africa particularly Nigeria. He further stated, “In recognition of the climate finance needs particularly in Nigeria and the urgent action required to combat climate change as well as its impact as enshrined in the Paris Agreement on Climate Change, NGX in 2016 conceptualized and developed the Green Bond Product Paper which was embraced and championed by the Debt Management Office and the Federal Ministry of Environment.

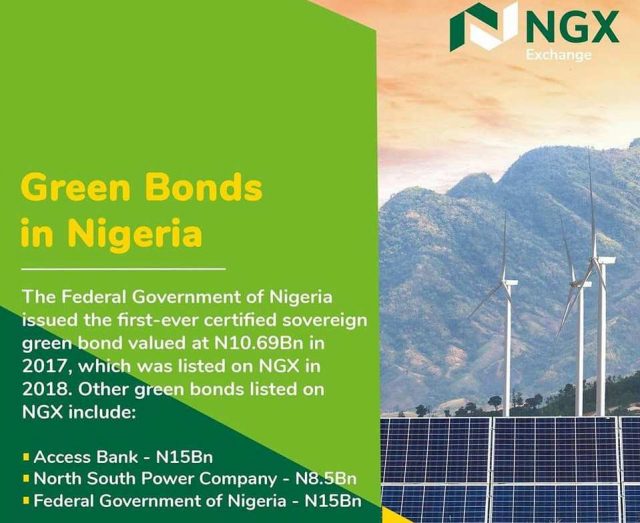

“This effort led to the issuance of the maiden N10.69 billion ($25.8 million) 13.48 per cent 5-year green bond in 2017 to fund projects to develop renewable energy. This was sequel to the ratification of the Paris Climate Agreement by the Federal Government of Nigeria which necessitated the need for long term capital to fulfill Nigeria’s Nationally Determined Contributions (NDCs) in reducing greenhouse gas emissions and ending gas flaring by 2030.

The second tranche, N15 billion ($36.1 million) 14.5 per cent 7-year Green Bond was issued in June 2019and was over-subscribed. The sovereign issuance paved way for corporate green bond market to emerge with N15 billion ($36.1 million) 15.5 per cent 5-year Fixed Rate Senior Unsecured Green Bond by Access Bank and N8.5 billion ($20.5 million) 15.6 per cent 15-year Guaranteed Fixed Rate Senior Green Infrastructure Bond by North South Power Company.

On 15 April 2021, North South Power Company (NSP) issued its second N6.33 billion ($15.3 million) 10-year 12 per cent Fixed Rate Series 2 Senior Green Bonds due 2031. It is noteworthy that all the corporate and sovereign Green Bonds are listed on NGX. These follow-on issuances have further increased investible instruments and deepened the Nigerian Green Bond market. It is noteworthy that the size of the Green Bond market is currently N55.52 billion ($133.8 million)”, the NGX CEO said.

NGX remains committed to fostering the growth of sustainable financial products, which integrate the financial risks and opportunities associated with climate change and other environmental challenges.

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email: govandbusinessj@gmail.com