SAT, JUNE 03 2023-theGBJournal |The NGX All-Share Index and Market Capitalization rose by 5.37% to close the week at 55,820.50 and N30.395 trillion respectively.

Similarly, all other indices finished higher with the exception of NGX Growth which depreciated by 0.18% while the NGX ASeM and NGX Sovereign Bond indices closed flat

Sixty-six equities rallied in price during the week higher than sixty equities in the previous week. Twenty-three equities depreciated in price higher than twenty-one in the previous week, while sixth-seven equities remained unchanged, lower than seventy-five recorded in the previous week.

Trading in the top three equities namely Access Holdings Plc, United Bank for Africa Plc and FBN Holding (measured by volume) accounted for 915.908 million shares worth N10.916 billion in 6,575 deals, contributing 35.42% and 23.40% to the total equity turnover volume and value respectively.

Intense buying activities on the first trading session of the holiday shortened week resulted in the market recording its biggest single-day gain (+5.2%) since 12 November 2020 (+6.2%).

Remarkably, investors’ interest in MTNN (+7.5%), DANGCEM (+7.4%), and BUAFOODS (+11.0%) underpinned the positive performance.

Thus, the YTD return for the index increased to 8.9%. Activity level was positive, as trading volume and value grew by 31.1% w/w and 37.0% w/w, respectively.

The Financial Services Industry (measured by volume) led the activity chart with 1.890 billion shares valued at N23.041 billion traded in 17,806 deals; thus contributing 73.10% and 49.40% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 170.218 million shares worth N638.188 million in 1,830 deals. The third place was the Consumer Goods Industry, with a turnover of 132.432 million shares worth N3.837 billion in 4,938 deals.

Meanwhile, global equities market was broadly mixed this week. While enthusiasm following the news of a debt ceiling deal waned, investors seemed more concerned about recent trends that defined the wider backdrop – moderating inflation, the outlook for the Federal Reserve policy path, and a slowing economy.

Accordingly, mixed sentiments dominated trading in US equities (DJIA: -0.1%; S&P 500: +0.4%) as investors assessed the labour market’s strength amid optimism that the Fed can create a smooth landing for the economy.

Meanwhile, European equities (STOXX Europe: -0.8; FTSE 100: -1.3%) were set to close lower on global slowdown concerns. Elsewhere, Asian markets were broadly positive, as the Nikkei 225 (+2.0%) and SSE (+0.5%) closed higher following positive reactions to China stimulus bets.

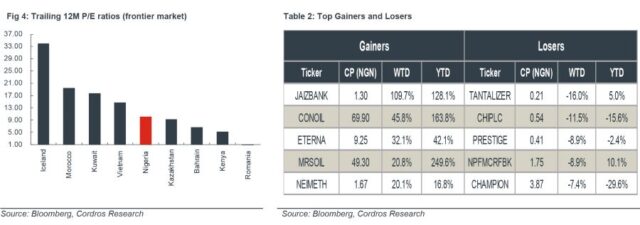

Finally, the Emerging market (MSCI EM: -1.1%) index declined consequent upon losses in Brazil (-0.3%), while the Frontier market (MSCI FM: +0.9%) index closed higher, driven by gains in Vietnam (+2.4%).

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com