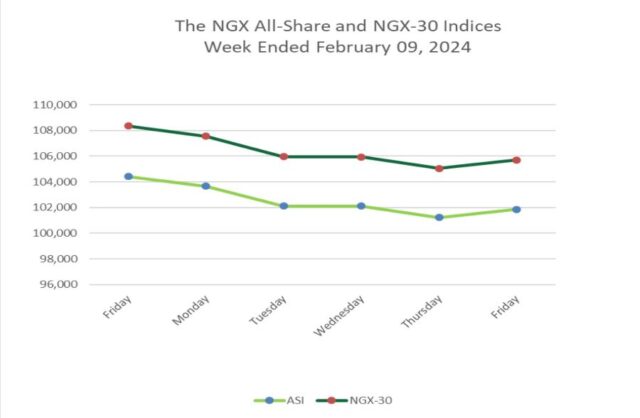

…The All-Share Index closed the week at 101,858.37 points, with the most significant impact from sell pressures witnessed on BUACEMENT (-10.0%) and MTNN (-5.2%)

SAT, FEB 10 2024-theGBJournal| The Nigerian stocks market recorded the sharpest weekly decline (-2.5% w/w) since the beginning of the year due to increased profit-taking activities on most trading days this week, save for the last trading day, as investors shifted their focus to the fixed-income market in pursuit of higher yields.

Analysts at Cordros Research expects the dominant weak sentiments witnessed this week to persist in the week ahead as investors continue to scale down exposure to equities amidst expectations of a continued uptick in fixed income yields.

The All-Share Index closed the week at 101,858.37 points, with the most significant impact from sell pressures witnessed on BUACEMENT (-10.0%) and MTNN (-5.2%).

All other indices finished lower with the exception of NGX ASeM which appreciated by 4.63%. Market capitalization fell 2.49% to N55.735 trillion.

Consequently, the MTD and YTD returns moderated to +0.7% and +36.2%, respectively. Activity levels were weak, as trading volume and value decreased by 36.8% w/w and 49.7% w/w, respectively.

Sectoral performance was bearish as the Banking (-6.9%), Industrial Goods (-4.2%), Insurance (-1.5%), Oil and Gas (-0.4%), and Consumer Goods (-0.1%) indices declined.

Meanwhile, sentiments were broadly positive in the global equities market as investors digested the latest batch of earnings updates and continued to assess the potential actions of global central banks regarding interest rates, while awaiting the revised US inflation print due later today (9 February).

Accordingly, US equities (DJIA: +0.2%; S&P 500: +0.8%) edged up, supported by positive earnings, most notably from entertainment giant, Walt Disney.

European equities (STOXX Europe: +0.3%; FTSE 100: -0.3%) remained mixed as higher bond yields offset positive reactions to strong corporate earnings.

In contrast, Asian markets (Nikkei 225: +2.0%; SSE: +5.0%) recorded positive performances, attributable to the weaker yen and robust earnings in Japan and reports of increased purchases of ETFs linked to Chinese stocks by a sovereign fund to support the market.

These actions come in the wake of additional support measures implemented by Chinese policymakers in recent weeks, including reductions in reserve requirements for banks and stricter regulations on short sales.

The Emerging market (MSCI EM: +0.9%) index closed higher, led by the positive sentiments in China (+5.0%), while the Frontier market (MSCI FM: -0.2%) index settled lower due to losses in Iceland (-1.7%).

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com