SAT, JUNE 17 2023-theGBJournal |The domestic equities market edged higher this week as the reforms of the new administration continued to spur an unprecedented rally in the market.

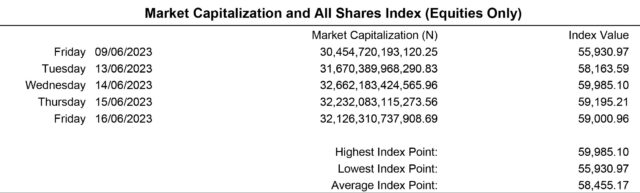

The All-Share index rose by 5.49% to 59,000.96 points, supported by strong interest in MTNN (+9.6%) and AIRTELAFRI (+7.8%).

All other indices finished higher with the exception of NGX Industrial Goods and NGX Growth which depreciated by 1.63% and 1.07% respectively while the NGX ASeM index closed flat.

Accordingly, the month-to-date and year-to-date returns for the index increased to +5.8% and +15.1%, respectively.

A total turnover of 4.276 billion shares worth N62.176 billion in 44,344 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 2.196 billion shares valued at N45.971 billion that exchanged hands last week in 31,655 deals.

Trading in the top three equities namely United Bank for Africa Plc, Guaranty Trust Holding Company Plc and Access Holdings Plc (measured by volume) accounted for 1.475 billion shares worth N27.648 billion in 8,875 deals, contributing 34.50% and 44.47% to the total equity turnover volume and value respectively.

In terms of activity levels, the trading volume and value grew by 94.7% w/w and 35.3% w/w, respectively. Sectoral performance was broadly positive, as the sectors under our coverage – Banking (+12.6%), Oil and Gas (+11.9%), Insurance (+9.0%), Consumer Goods (+4.1%), and Industrial Goods (+5.8%) indices – recorded gains.

In the week ahead, analysts at Cordros Research told theGBJournal that they expect profit-taking activities following the recent rally in the market.

”However, we expect this to be tempered by bargain-hunting activities from “early bird” investors ahead of the H1-23 earnings season,” they added.

Meanwhile, global stocks rallied this week as signs of easing inflationary pressures and slowing economic growth raised hope that the US Federal Reserve could end its monetary tightening campaign soon. Additionally, sentiments were buoyed by increased bets on Chinese stimulus and enthusiasm surrounding artificial intelligence firms.

Accordingly, US equities (DJIA: +1.6%; S&P 500: +3.0%) were on course for weekly gains as a slew of economic data (inflation and jobless claims) fueled hopes of a shift in the Fed’s policy.

Similarly, European equities (STOXX Europe: +1.2; FTSE 100: +1.3%) were on track to close higher following the gains on Wall Street.

In Asia, the Nikkei 225 (+4.5%) rallied as the Bank of Japan (BOJ) kept its ultra-loose monetary policy and signaled no change to its yield curve control policies.

Likewise, the Chinese market (SSE: +1.3%) advanced following optimism that Beijing will ramp up stimulus measures to bolster growth after a string of gloomy economic reports.

Finally, the Emerging (MSCI EM: +2.1%) and Frontier (MSCI FM: +1.0%) market indices closed positively underpinned by bullish sentiments in China (+1.3%) and Vietnam (+0.7%), respectively.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com