TUE, JUNE 20 2023-theGBJournal |The Nigerian equities market traded marginally higher as investors remained cautious, evaluating the impact of the new FX policy.

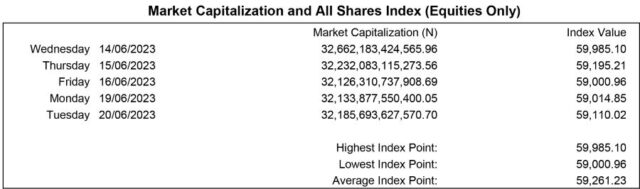

Bargain hunting in SEPLAT (+3.0%) drove the benchmark Index 0.2% higher, pushing the NGX ASI up to 59,110.02 points, with the MTD and YTD gains increasing to +6.0% and +15.3%, respectively.

The total volume traded declined by 34.1% to 588.85 million units, valued at NGN8.96 billion, and exchanged in 8,272 deals. UBA was the most traded stock by volume at 78.51 million units, while GTCO was the most traded stock by value at NGN2.11 billion.

On sectors, the Insurance (+1.9%), Oil & Gas (+1.4%), Industrial Goods (+0.1%), and Consumer Goods (+0.1%) indices advanced, while the Banking index was unchanged.

As measured by market breadth, market sentiment was positive (2.6x), as 50 tickers gained relative to 19 losers. SKYAVN (+10.0%) and ACADEMY (+10.0%) topped the gainers’ list, while CILEASING (-10.0%) and CORNERST (-9.8%) recorded the most significant losses of the day.

Meanwhile, the local currency recovered from previous day loss to the greenback, gaing 1.8% to N756.61/US$ at the I&E window.

The overnight lending rate was unchanged at 12.1%, as the system liquidity closed in a net long position (N866.57 billion).

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com