…In 2023, 136 such companies raised approximately US$485 million, accounting for 27% of the total number of unique companies backed by venture capital.

TUE, MAR 26 2024-theGBJournal| Of the 142 venture capital (VC) deals in 2023 valued at US$431 million sealed in West Africa, Nigeria accounted for 19% of of the total, retaining its position at the forefront for the third consecutive year, according to AVCA, the African Private Capital Association who on Monday released its much anticipated 2023 Venture Capital in Africa Report.

Africa attracted a combined US$4.5 billion in venture capital and venture debt investment in 2023, across 603 deals with West Africa maintaining its pre-eminence in terms of venture capital deal volume for the third successive year, demonstrating a consistent attraction for venture investments

According to the report, ”this enduring prominence underscores Nigeria’s vital role in Africa’s silicon savannah, alongside South Africa (18%), Kenya (14%) and Egypt (11%) – Africa’s “Big 4” – which once again emerged as the primary destinations for venture capital.”

The report, a comprehensive overview of Africa’s innovative ecosystem, provides critical insights into the sub-regions, countries, and sectors that have cemented Africa’s rising position as a region for venture capital (VC) activity.

It also provides an analysis of the latest trends and development of Africa’s start-up investment landscape and the profile of the investors active on the continent.

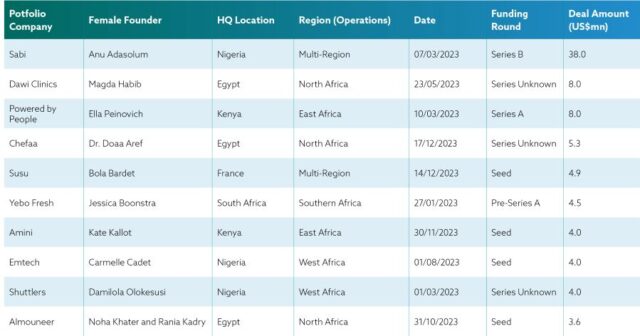

Meanwhile, venture capital fundraising continues to be a challenging environment for female entrepreneurs, with only 16% of funding recipients in 2023 having a female CEO.

According to the report, this figure, though an improvement from previous years, still reflects a significant gender gap in the recipients of venture capital.

Historically, the proportion of deals in companies with a female CEO has shown a gradual increase, from 11% in 2020 to 16% in 2023.

While this suggests a slowly evolving landscape that is becoming increasingly receptive to female entrepreneurs, much work remains to be done to achieve equity in funding distribution.

A more optimistic picture on the progress to gender parity is painted when the broader category of gender-diverse startups (defined as those with at least one female founder) is considered.

In 2023, 136 such companies raised approximately US$485 million, accounting for 27% of the total number of unique companies backed by venture capital.

However, this only corresponds to 13% of the total deal value for the year, highlighting a discrepancy between the number of companies funded and the proportion of total capital received.

An examination of deal activity to startups that are entirely female founded further highlights this disproportionality, and the financial challenges faced by female entrepreneurs in Africa. In 2023, 36 unique female-founded startups successfully raised venture capital, capturing just 7% of deal volume for the year.

The presence of mixed-gender teams has been shown to significantly increase funding opportunities. Teams that have at least one female founder have historically commanded a far greater percentage

of venture capital dealmaking compared to all-women teams.

This trend is not unique to Africa’s venture capital industry, it was equally visible in the

American market where it has remained consistent for over a decade.

The percentage of venture capital allocated to all-female teams in the US stood at just 1.9% (US$4.5 billion) in 2022, increasing to 17.2% when the team was mixed-gender28.

The importance of fostering diversity within startup teams is highlighted by these disparities, underscoring the need for continued efforts to support and invest in women entrepreneurs at the global level.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com