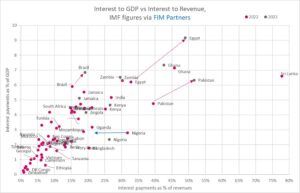

TUE, JUNE 13 2023-theGBJournal |One of the my most useful charts since 2020 has been this one – showing when the debt burden has got too high.

Sri Lanka + Ghana in top right have both defaulted, Zambia is not in a good place and did too. Egypt is clearly risky. Pakistan I think will default (so does the mkt). Kenya looks similarly risk to India, but India and Egypt both have the advantage of lots of local savings.

Now you’ll see the blue arrow on the graph .. which is where Nigeria has moved on this chart .. because Nigeria’s Bureau of Statistics last week suddenly announced the discovery of a lot more government revenues (and presumably spending) than it has ever recorded before. The country’s debt burden suddenly looks much more manageable.

I’m assuming there’s been an equal rise in government spending, and no change in government interest.

The entire explanation from the NBS for this is ..

“The revised computation took into account wider coverage of data at the Federal, State, and Local Government levels, and revenue items not previously included in the computations, particularly, relevant revenue collected by other agencies of government”

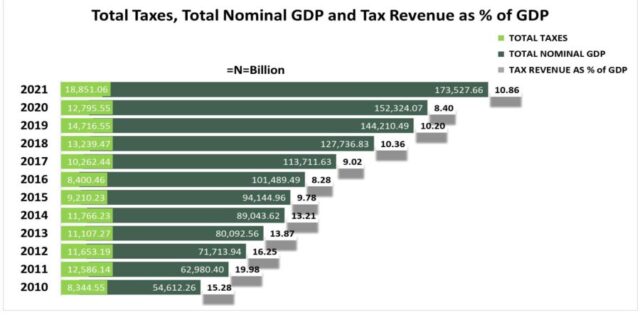

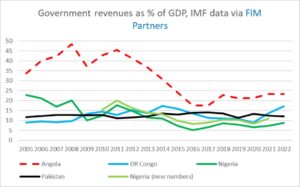

The revision does not look that significant if we show it as a revenues to GDP chart (see light green vs dark green below). But it is an improvement, and in 2021, it means revenues were 49% higher than the IMF was reporting for 2021 in their April 2023 economic outlook. If France found 49% more revenues, it’s revenues to GDP would be 79% of GDP, not 53% of GDP.

How credible is this sudden discovery of more revenues? It appears to give the government more room to fund its budget deficits so it’s very helpful timing. It also reduces the share of oil in the budget revenues which makes Nigeria look less vulnerable to lower oil prices.

Public external debt to revenues ratio which was 127% in 2021, and 106% in 2022 (based on old IMF figures) will now look better.

At one level it doesn’t matter. The IMF will have to revise all its figures, and rating agencies will have to take this into account, and markets should treat Nigeria a little more favourably as a result.

I can believe that Nigeria’s govt has not been recording all the revenues and spending that others might. One official admitted to me they never see a single naira from the immense visa fees that get charged to foreigners when they are lucky enough to visit Nigeria.

Maybe this is now getting recorded. Meanwhile, Lagos businesses have told me the tax squeeze from officials makes Nigeria feel like a country where tax revenues are 40% of GDP, not 7% of GDP (the prior number for 2021).

However improvement only becomes helpful, if the government can impose its will on all the tax collecting agencies that have not been recorded before.

Also this doesn’t clarify what share of these extra revenues are federal government or state and local govt. Why does that matter? Because interest payments to federal revenues have been estimated at 88% in 2021 and 96% in 2022, based on the latest IMF Article IV. The federal govt carries all the debt, but only gets half of government revenues (although now it’s probably more like a third or 40% of all revenues – we don’t know because the NBS pdf doesn’t break it down).

Conclusion: This is an additional positive for Nigeria. Combined with the fuel subsidy removal and the likely change of FX policy, rating agencies will now have three reasons to be more positive on Nigeria.

I suspect S&P (B-) will improve its rating outlook from negative to stable, and the other two (Caa1, B-) will remain at stable in the coming 6-12 months.

Charlie Robertson, Head of Macro Strategy, FIM Partners UK Ltd|crobertson@fimpartners.com

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com