…With the right policy mix, Nigeria could return … and back in 2012 just being included in one of those bond indexes was expected to result in $1bn of inflows.

…As recently as 2015, Nigeria was over 10% of the Frontier equity index, and the head of the stock exchange at the time hoped to grow the stock market so much that it might be considered for emerging market inclusion

Charlie Robertson

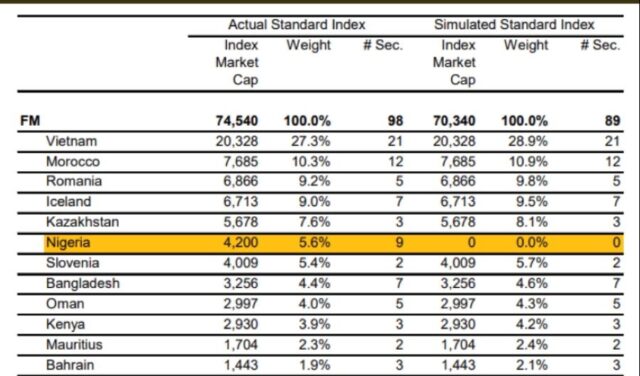

MON, OCT 30 2023-theGBJournal|I posted a thread on Nigeria getting excluded from the MSCI Frontier index … and there’s a picture below showing how Nigeria’s 5.6% weight in the index may be re-allocated.

It is the last and final blow to Nigeria from the restrictive FX policies pursued by Nigeria in 2015-17 and again in 2020-23. Global investors can cope with low growth, and volatile economies, but they can’t cope with FX restrictions.

For Nigeria, this means it has now been excluded from all the indexes I can think of. It was thrown out of the Barclays and JP Morgan local currency bond indexes in 2015/16 – and the FTSE Russell and now MSCI Frontier indexes with their decisions in the last two months.

With the right policy mix, Nigeria could return … and back in 2012 just being included in one of those bond indexes was expected to result in $1bn of inflows.

As recently as 2015, Nigeria was over 10% of the Frontier equity index, and the head of the stock exchange at the time hoped to grow the stock market so much that it might be considered for emerging market inclusion.

Now, Nigeria will be an after-thought for global portfolio investors in local currency bonds or equities. As a stand-alone country, it becomes an off-index bet which most investors will ignore after being scarred by being locked inside the market in 2015-17 and again in 2020-23.

As readers of the Time Travelling Economist will know (free intro here) – Nigeria has a savings shortage due to high fertility, and portfolio investors were a helpful part of the mix to help compensate for that savings shortage.

Yes, that “hot” money could always leave, but Vietnam or Romania (which was included in one local currency bond index at the same time as Nigeria back in 2012/13) show that sometimes that foreign participation just grows and grows.

Sadly, they also support the point of the The Time Travelling Economist that savings mostly flow to countries that already have savings, because high local savings = good local infrastructure = a good economic performance.

Portfolio investors are often the first to dip their toe into the market, and when they do well, foreign direct investors notice. When they’ve been driven away, that’s another group of investors who are unlikely to be talking positively about Nigeria as an investment choice.

Does this ruin the investment case for Nigeria? No. The damage from a barely functioning FX market was already done. But exclusion from all bond and equity indexes does raise the hurdle to attracting new investment, and that’s unhelpful for Nigeria.

Impact on other countries

There is a benefit to others from Nigeria’s index exclusion. Its weight in the MSCI Frontier index will now be re-allocated.

Kazakhstan may rise 0.5 percentage points, Romania 0.6 percentage points and Vietnam 1.2 percentage points. I’d guess maybe $10bn follows this index, and most foreign investors don’t track the index closely, but 1) if it was all tracker funds and 2) if foreigners could get their money out of Nigeria easily, it would imply $120m more for Vietnam, $60m for Romania, $50m for Kazakhstan.

This would not be that meaningful for Vietnam where average daily equity trading volume in July 2023 was $770m according to this report. https://www.wam.ae/en/details/1395303183954

A more recent 2022 figure for Romania put average daily equity trading volume at RON100m or roughly $20m https://www.romania-insider.com/bucharest-stock-exchange-liquidity-records-2022#:~:text=The%20average%20daily%20trading%20liquidity,record%20for%20the%20local%20market.

But for Kazakhstan, I can find this story suggesting average trading volume was just $0.1m. https://astanatimes.com/2023/07/kase-index-grows-10-9-since-start-of-2023/#:~:text=The%20average%20daily%20trading%20volume,totaling%20334%2C000%20tenge%20(%24761).

Any re-allocation to Kazakhstan could therefore lift its market pretty significantly. And when investors are looking for non-Gulf oil exporters to invest in, that could be an exciting trade.

Coincidentally, Kazakhstan’s rating outlook was just upgraded to positive on Friday night by Moody’s.

Note the figures above may not be comparable. Figures my equity strategy team at RenCap used in 2019 showed Vietnam at around $120m a day, Romania at $3m a day and Kazakhstan at a rounded down $0m a day.

Kenya becomes the main MSCI SSA equity market in Frontier now (4.2%) – ahead of Mauritius (2.3%), Ivory Coast and Senegal.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com