…Buying interest in AIRTELAFRI (+4.8%) propelled the All-Share Index to a 0.9% w/w gain, to reach 100,539.40 points

…activity levels were subdued, with total trading volume increasing slightly by 2.2% w/w while total trading value declined by 50.3% w/w.

…Trading in the top three equities namely Jaiz Bank Plc, Cutix Plc and FCMB Group Plc (measured by volume) accounted for 1.140 billion shares worth N4.632 billion in 2,701 deals

… Global stocks were broadly negative this week as economic and geopolitical concerns overshadowed optimism about potential interest rate cuts

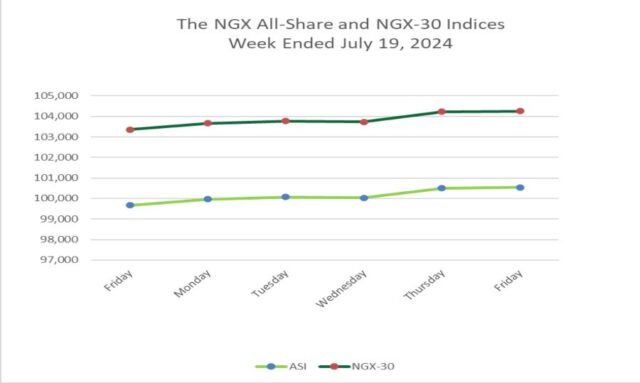

SAT JULY 20 2024-theGBJournal|NGX All-Share Index rose Friday, as traders wrapped up the week defined by bullish sentiments and Q2-24 corporate earnings announcements.

Notably, buying interest in AIRTELAFRI (+4.8%) propelled the All-Share Index to a 0.9% w/w gain, to reach 100,539.40 points — its highest level since 15 April (101,777.12 points). Market Capitalization also settled 0.86% higher to N56.929 trillion.

Consequently, the Month-to-Date and Year-to-Date returns rose to +0.5% and +34.5%, respectively.

However, activity levels were subdued, with total trading volume increasing slightly by 2.2% w/w while total trading value declined by 50.3% w/w.

Sectoral performances were mixed as the Insurance (-4.9%), Consumer Goods (-0.2%) and Oil and Gas (-0.1%) indices recorded losses, while the Industrial Goods (+0.1%) index advanced. Also, the Banking index closed flat.

Trading in the top three equities namely Jaiz Bank Plc, Cutix Plc and FCMB Group Plc (measured by volume) accounted for 1.140 billion shares worth N4.632 billion in 2,701 deals, contributing 40.32% and 10.93% to the total equity turnover volume and value respectively.

Thirty-seven equities appreciated in price during the week higher than thirty- four equities in the previous week. Thirty-four equities depreciated in price lower than thirty-eight in the previous week, while eighty equities remained unchanged, lower than eighty-two recorded in the previous week.

In the interim, we anticipate that the full commencement of the H1-24 earnings season will shape market sentiments.

Additionally, we believe that investors will be closely monitoring the outcome of the MPC meeting scheduled for next week to gain further insight into the direction of yields in the fixed-income market and the attendant impact on the equities market.

Meanwhile, Global stocks were broadly negative this week as economic and geopolitical concerns overshadowed optimism about potential interest rate cuts.

As of the time of writing, US equities (DJIA: +1.7%; S&P 500: -1.3%) traded with mixed sentiments as expectations of an upcoming Federal Reserve rate cut, driven by signs of a cooling labor market, were offset by selloffs in technology stocks following reports that the US might renew export restrictions on semiconductor equipment to China.

Elsewhere, European equities (STOXX Europe: -1.9%; FTSE 100: -0.6%) were set to close lower as investors digested the latest ECB interest rate decision amid a higher-than-expected UK inflation data. In Asia, Japanese equities (Nikkei 225: -2.7%) declined as the Japanese yen strengthened significantly against the US dollar on bets that the Bank of Japan would intervene in the FX market.

Conversely, the Chinese market (SSE: +0.1%) recorded a marginal gain as optimism for more stimulus measures by the government dampened persistent concerns over a renewed trade war between Beijing and Washington.

The Emerging Markets index (MSCI EM: -1.6%) closed lower, driven by losses in Taiwan (-4.4%), while the Frontier Markets index (MSCI FM: +0.7%) advanced, supported by gains in Romania (+1.3%).

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com