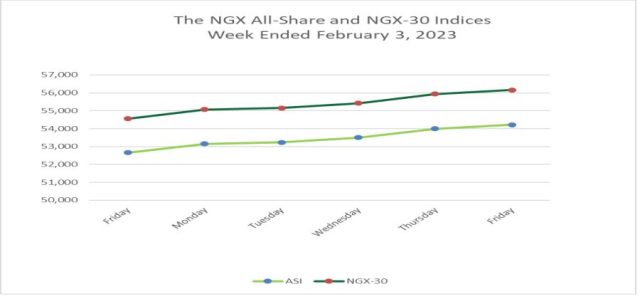

FRI. 04 FEB, 2023-theGBJournal| Closing the week, the NGX Exchange ended Friday’s session on a positive note, bringing the All-Share index up by 0.40% to close at 54,213.09 points.

Consequently, having gained in all five trading sessions this week, the ASI closed 2.95% higher w/w, its fourth consecutive weekly gain.

A total turnover of 3.789 billion shares worth N27.500 billion in 20,333 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 756.769 million shares valued at N13.653 billion that exchanged hands last week in 18,248 deals, according to NGX data.

Trading in the top three equities namely Universal Insurance Plc, Guaranty Trust Holding Company Plc and Zenith Bank Plc. (measured by volume) accounted for 3.048 billion shares worth N4.653 billion in 2,674 deals, contributing 80.45% and 16.92% to the total equity turnover volume and value respectively.

Sustained interests in telco heavyweight, MTNN (+1.88%), alongside ZENITHBANK (+0.40%), GTCO (+0.60%) and WAPCO (+0.60%) kept the market in the green.

Over the course of the week, strong performance across index heavyweights, AIRTELAFRI (+3.11% w/w), MTNN (+5.73% w/w) and SEPLAT (+20.45% w/w) drove the market’s performance. As a result, the year-to-date (YTD) return rose to 5.78%, while the market capitalization gained N847.08bn w/w to close at N29.53trn.

Analysis of Friday’s market activities showed trade turnover settled lower relative to the previous session, with the value of transactions down by 70.82%. A total of 268.02m shares valued at N2.35bn were exchanged in 4,017 deals. GTCO (+0.60%) led the volume and value charts with 20.80m units traded in deals worth N522.21m.

Market breadth closed positive at a 4.17-to-1 ratio, with advancing issues outnumbering declining ones. FTNCOCOA (+10.00) topped twenty-four (24) others on the leader’s log, while MAYBAKER (-2.89%) led five (5) others on the laggard’s table.

Meanwhile, global stocks posted broadly positive performances as investors digested key central bank decisions, economic data, and corporate earnings. In line with this, US equities (DJIA: +0.2%; S&P 500: +2.7%) are on course for a weekly gain as better-than-expected earnings from Meta, and the Fed’s dovish remarks supported sentiments. Likewise, European equities (STOXX Europe: +0.9%; FTSE 100: +0.7%) remained resilient as the European Central Bank’s (ECB) hawkish comments failed to derail investor hopes of an end to the global rate hiking cycle.

In Asia, the Japanese market (Nikkei 225: +0.5%) edged higher as sentiments remained cautious in anticipation of US nonfarm payroll data. On the other hand, Chinese equities (SSE: 0.0%) struggled for direction amid a dearth of positive triggers.

Elsewhere, the Emerging (MSCI EM: -0.5%) market index declined following selloffs in South Korea (-0.2%), while the Frontier (MSCI FM: +0.4%) market index inched higher, supported by gains in Morocco (+2.7%).

Corporate Actions

Geregu Power Plc:

Proposed Dividend: N8.00

Proposed Bonus: null FOR null

Qualification Date: 02/27/2023

Payment Date:

Closure of Register Date: 02/28/2023

MTN Nigeria Communications Plc:

Proposed Dividend: N10.00

Proposed Bonus: null FOR null

Qualification Date: 03/27/2023

Payment Date: 04/20/2023

Closure of Register Date: 03/28/2023

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com