…Market Capitalization depreciated by 2.33% to N55.605 trillion to close the week’s trading.

…The Month-to-Date and Year-to-Date returns settled at -1.8% and +31.3%, respectively. However, activity levels improved as the total trading volume and value increased by 25.4% and 10.9% w/w

SAT JULY 27 2024-theGBJournal| The Nigerian equities market started the week on a slightly positive note, but negative sentiments resurfaced during the week as investors reacted negatively to the recent hike in the benchmark interest rate from 26.25% to 26.75%.

Particularly, increased sell pressures was observed across the industrial goods, consumer goods, and banking stocks, as profit-taking activities in DANGCEM (-10.0%), UBA (-7.9%), FBNH (-4.8%) and DANGSUGAR (-7.3%) triggered a 2.3% w/w decline in the All-Share Index to 98,201.49 points.

Market Capitalization depreciated by 2.33% to N55.605 trillion to close the week’s trading.

Similarly, all other indices finished lower with the exception of NGX MERI Value which appreciated by 0.72%, while the NGX ASeM and NGX Sovereign Bond indices closed flat.

Consequently, the Month-to-Date and Year-to-Date returns settled at -1.8% and +31.3%, respectively. However, activity levels improved as the total trading volume and value increased by 25.4% and 10.9% w/w, respectively.

From a sectoral perspective, losses in the Industrial Goods (-5.9%), Banking (-2.9%), Consumer Goods (-0.7%), Oil and Gas (-0.5%), and Insurance (-0.3%) indices reflected the overall market performance.

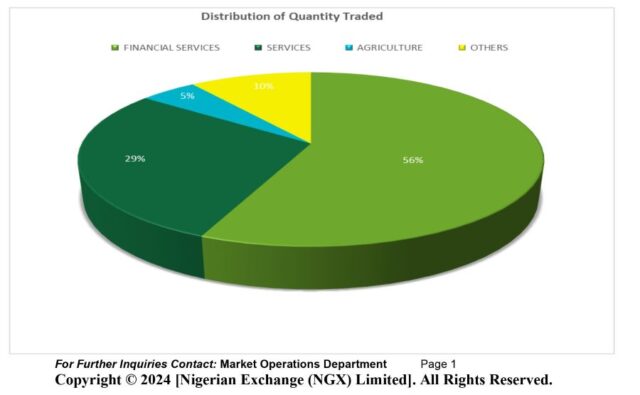

Trading in the top three equities namely Tourist Company of Nigeria Plc, FCMB Group Plc and Abbey Mortgage Bank Plc (measured by volume) accounted for 1.876 billion shares worth N8.511 billion in 935 deals, contributing 52.73% and 18.02% to the total equity turnover volume and value respectively.

A total turnover of 3.557 billion shares worth N47.220 billion in 42,871 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 2.827 billion shares valued at N42.366 billion that exchanged hands last week in 44,277 deal.

Twenty equities appreciated in price during the week lower than thirty-seven equities in the previous week. Forty-seven equities depreciated in price higher than thirty-four in the previous week, while eighty-four equities remained unchanged, higher than eighty recorded in the previous week.

While the recent decision of the MPC may further suppress investors’ sentiments in the near term, we anticipate that the ongoing H1-24 earnings season will ultimately guide market’s direction over the short-term.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com