MON, 31 OCT, 2022-theGBJournal| Nigerian equities extended losses for the third consecutive session to open the week as the All-Share Index closed 0.12% weaker to settle at 43,858.34.

Selloffs of telco giant, MTNN (-0.05%) and Tier-1 banks, ZENITHBANK (-0.50%) and GTCO (-1.68%) were the primary drivers of the market decline.

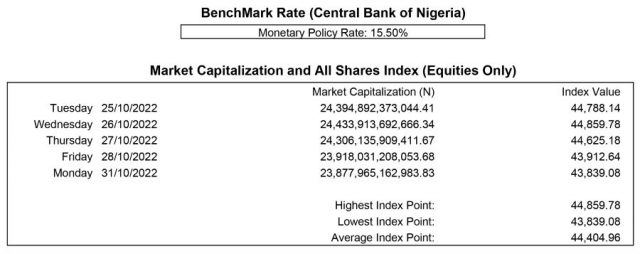

The ASI’s year-to-date (YTD) return fell to 2.67%, while the market capitalization lost N28.69bn to close at N23.88trn.

Analysis of today’s market activities showed trade turnover settled lower relative to the previous session, with the value of transactions down by 21.13%. A total of 161.08m shares valued at N3.47bn were exchanged in 4,258 deals. TRANSCORP (+1.90%) led the volume chart with 19.04m units traded while SEPLAT (+0.00%) led the value chart in deals worth N1.32bn.

Market breadth closed positive at a 1.88-to-1 ratio with declining issues outnumbering advancing ones. INTBREW (-9.78%) topped seventeen others on the laggard’s table, while NAHCO (+9.88%) led seven others on the leader’s log.

Dividend Information

| Company | Dividend (Bonus) | Closure Date | Payment Date |

| SEPLAT | $0.025 (interim) | 11-Nov-22 | 6-Dec-22 |

| ACCESSCORP | N0.20 (interim) | 28-Sep-22 | 12-Oct-22 |

| GTCO | N0.30 (interim) | 21-Sep-22 | 30-Sep-22 |

| UBA | N0.20 (interim) | 22-Sep-22 | 29-Sep-22 |

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com