…the year-to-date (YTD) return rose to 41.39%, while the market capitalization gained N2.11 trillion w/w to close at N57.85 trillion.

…Financial Services Industry (measured by volume) stocks led the activity chart with 1.127 billion shares valued at N18.908 billion traded in 19,424 deals

SAT, FEB 17 2024-theGBJournal| The Nigerian equities market closed higher this week as investors re-entered the market, and despite profit-taking activities on banking stocks earlier in the week.

Buy interests in BUAFOODS (+10.00%), ZENITHBANK (+0.14%), and GEREGU (+9.90%) offset selloffs in GTCO (-0.13%), ACCESSCORP (-2.17%) and FLOURMILL (-10.00%) keeping the market in the positive terrain.

Having gained in 4 of 5 trading sessions this week, the ASI closed 3.79% higher w/w, with all other indices finishing higher with the exception of NGX CG, NGX Banking, NGX AFR Bank Value, NGX AFR Div Yield, NGX MERI Growth, NGX Industrial Goods, NGX Growth and NGX Sovereign Bond which depreciated by 0.18%, 1.34%, 3.32%, 0.32%, 3.43%, 1.83%, 6.50% and 0.02% respectively.

Over the course of the week, strong performances in AIRTELAFRI (+10.00% w/w), BUAFOODS (+20.82% w/w), and GEREGU (+33.30% w/w) drove the market’s positive performance, outweighing losses in BUACEMENT (-4.62% w/w), ACCESSCORP (-9.09% w/w), and DANGSUGAR (-3.33% w/w).

Consequently, the year-to-date (YTD) return rose to 41.39%, while the market capitalization gained N2.11 trillion w/w to close at N57.85 trillion.

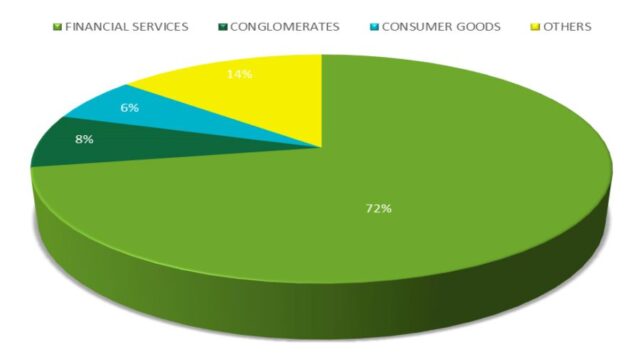

Financial Services Industry (measured by volume) stocks led the activity chart with 1.127 billion shares valued at N18.908 billion traded in 19,424 deals, thus contributing 72.27% and 51.81% to the total equity turnover volume and value respectively.

Trading in the top three equities namely United Bank for Africa Plc, FBN Holdings Plc and Guaranty Trust Holding Company Plc(measured by volume) accounted for 389.286 million shares worth N11.757 billion in 5,372 deals, contributing 24.96% and 32.21% to the total equity turnover volume and value respectively.

Analysts at Cordros Research tells theG&BJournal that they expect sentiments to be determined by movement of yields in the fixed income market in the coming week.

Also, as we move towards the earnings season, further earnings releases and possible dividend declarations may be the catalysts for another spurt of positive sentiment which supports buying activities on the bourse.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com