FRI, 18 NOV, 2022-theGBJournal| The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) is expected to hold its last meeting of the year on the 21st and 22nd of November.

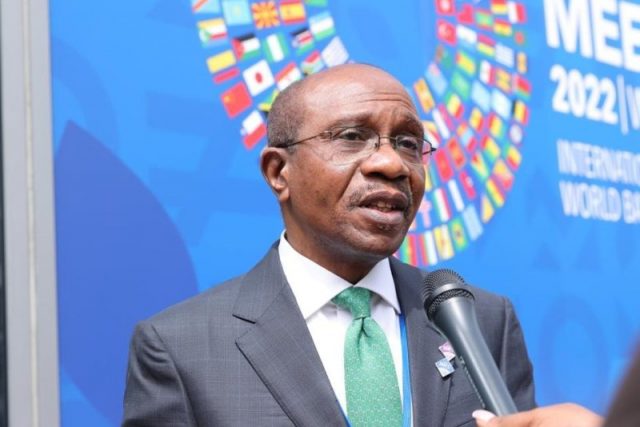

In the last two meetings, the CBN governor, Godwin Emefiele, maintained during the post-Monetary Policy Committee (MPC) conferences that the MPC would maintain its interest rate hikes until there is a deceleration in the inflation path, more so that ‘’time-tested monetary policy has shown that inflation must lag policy rates’’.

Besides, consumer price levels at a 17-year high have a dire implication on macroeconomic stability, depressing the long-run potential GDP. Consumer prices maintained their uptrend for the ninth consecutive month, notching higher by 31bps to 21.09% y/y in October as existing challenges remain intact amid the impact of base effects from the prior year.

On the one hand, food prices (+39bps to 23.72% y/y) remain at a 17-year high, underpinned by the unfavourable base effects from the prior year, increased flooding incidents and lingering structural challenges impeding food supply.

On the other hand, the core inflation increased by 16bps to 17.76% y/y. Coupled with the low base effect from the prior year, the price pressures synchronised neatly with the intermittent PMS scarcity witnessed during the review period, stubbornly high gas and energy prices, lingering currency pressures and build-up of higher naira liquidity as the campaign season starts.

Besides, the upcoming election spending could continue to fuel higher inflation expectations.

Accordingly, there is the need to march on with the interest rate hike to re-anchor inflation expectations back to the CBN’s medium-term targets. On a balance of factors, analysts now expect the MPC to raise the MPR further by 100bps, given the continued hawkish rendition of global central banks amid a comfortable level of domestic growth and persistent inflationary pressures.

As in prior meetings, the Committee is faced with the decision of holding or hiking the Monetary Policy Rate (MPR) further at a time global central banks are marching on with their interest rate hiking cycle despite the increasing risks to growth.

The Committee, as in previous meeting will be assessing the domestic and global economic environment in the context of developing key economic and financial indicators since its last policy meeting in September.

Analysts tell theG&BJournal that, the absence of a significant shock to economic activities since the previous meeting will provide respite that the economy likely maintained its steady growth path in Q3-22.

‘’We believe the preceding will give the Committee a reason to maintain its fight against the stubbornly-high inflationary pressures, more so that a continued negative real interest rate could dampen domestic investments and undermine the local currency’s stability,’’ says Cordros Research.

‘’Moreover, the more hawkish rendition from global central banks also supports the Committee towing the same path to reduce external pressures. Thus, we think a further tightening of the policy rate is necessary to re-anchor inflation expectations which an econometric study by the CBN shows is the most significant driver of actual inflation in Nigeria, according to one of the Committee members. Consequently, we think a further interest rate hike is likely at the meeting. Accordingly, we expect the Committee to raise the MPR by an additional 100bps,’’ Cordros said.

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com