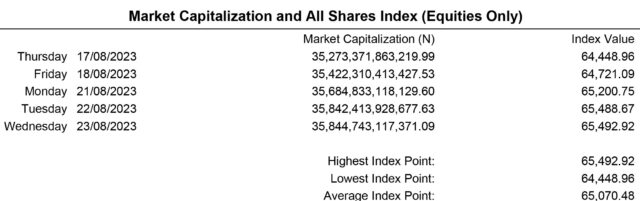

WED, AUGUST 23 2023-theGBJournal |The Nigerian equities market traded marginally higher as buying interest in TRANSCORP (+9.0%) and DANGSUGAR (+7.0%) triggered a 1bp expansion in the All-Share Index to 65,492.92 points.

Accordingly, the Month-to-Date and Year-to-Date returns printed +1.8% and +27.8%, respectively.

The total volume traded declined by 1.8% to 348.32 million units, valued at NGN4.05 billion, and exchanged in 6,237 deals. TRANSCORP was the most traded stock by volume and value at 144.71 million units and NGN682.61 million, respectively.

Analysing by sectors, the Consumer Goods (+0.4%) and Insurance (+0.4%) indices advanced, while the Oil & Gas (-1.7%) and Banking (-0.7%) indices declined. On the other hand, the Industrial Goods index closed flat.

As measured by market breadth, market sentiment was negative (0.8x), as 22 tickers lost relative to 26 gainers. CONOIL (-10.0%) and DAARCOMM (-9.4%) topped the losers’ list, while ABCTRANS (+9.6%) and THOMASWY (+9.3%) recorded the most significant gains of the day.

The naira depreciated by 0.4% to N773.42/USD at the I&E window.

The overnight lending rate remained at 24.8%, as the system liquidity closed in a net short position (NGN212.08 billion).

The NTB secondary market traded on calm note as participants stayed on the sidelines in anticipation of the outcome of today’s NTB PMA. Consequently, the average yield closed flat at 8.3%. Similarly, the average yield was unchanged at 11.2% in the OMO segment.

Meanwhile, the FGN bond secondary market closed on a bearish note, as the average yield expanded by 2bps to 14.1%. Across the benchmark curve, the average yield expanded at the short (+8bps) and long (+1bp) ends as investors sold off the FEB-2028 (+41bps) and MAR-2050 (+7bps) bonds, respectively. Meanwhile, the average yield declined at the mid (-2bps) segment following demand for the APR-2029 (-6bps) bond.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com