…Naira rebounds to N907.11/USD

…Nigerian Treasury bills secondary market were calm as the average yield remained at 6.3%.

SAT, DEC 30 2023-theGBJournal|The Nigerian equities market ended the last trading session of the year on a bullish note as bargain hunting in TRANSCOHOT (+10.0%) and STANBIC (+5.5%) triggered a 0.4% gain in the benchmark index.

As a result, the All-share Index closed at 74,773.77 points – the highest point on record. Sequentially, the Month-to-Date and Year-to-Date gains increased to +4.8% and +45.9%, respectively.

All other indices finished higher with the exception of NGX Consumer Goods and NGX Lotus II which depreciated by 1.46%, and 0.08% respectively while the NGX ASeM index closed flat.

Trading in the top three equities namely Jaiz Bank Plc, Zenith Bank Plc and Transnational Corporation Plc (measured by volume) accounted for 244.764 million shares worth N3.500 billion in 3,630 deals, contributing 20.64% and 11.14% to the total equity turnover volume and value respectively.

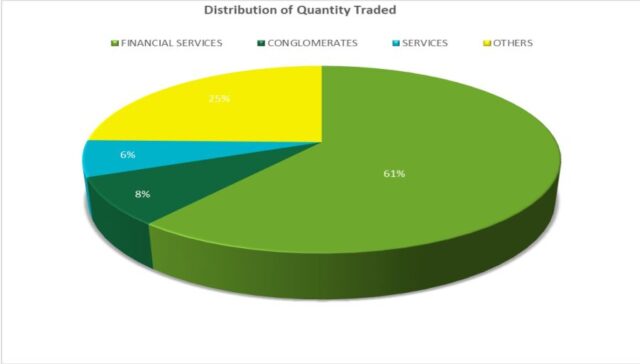

The total volume of trades decreased by 0.6% to 368.63 million units, valued at NGN12.82 billion, and exchanged in 6,732 deals.

ZENITHBANK was the most traded stock by volume at 28.88 million units, while GEREGU was the most traded stock by value at NGN7.22 billion.

Sectoral performance was mixed, as the Insurance (+2.9%), Banking (+1.1%) and Oil & Gas (+0.1%) indices advanced while the Consumer Goods (-1.4%) index declined. Meanwhile, the Industrial Goods index closed flat.

As measured by market breadth, market sentiment was positive (3.2x), as 48 tickers gained relative to 15 losers.

TRANSCOHOT (+10.0%) and LEARNAFRCA (+10.0%) recorded the most significant gains of the day, while SUNUASSUR (-5.2%) and FTNCOCOA (-4.5%) topped the losers’ list.

Overall, Sixty-five equities appreciated in price during the week higher than fifty-five equities in the previous week.

Twenty-four equities depreciated in price lower than thirty-five in the previous week, while sixty-six equities remained unchanged, higher than sixty-five recorded in the previous week.

Currency

The naira appreciated by 15.0% to N907.11/USD at the Nigerian Autonomous Foreign Exchange Market (NAFEM).

Money market & fixed income

The overnight lending rate contracted by 23bps to 15.5%, in the absence of any significant inflows into the system.

Activities in the Nigerian Treasury bills secondary market were calm as the average yield remained at 6.3%. Similarly, the average yield was flat at 11.4% in the OMO segment.

Trading in the Treasury bond secondary market was bullish, as the average yield declined by 6bps to 14.1%.

Across the benchmark curve, the average yield closed flat at the short end but dipped at the mid (-31bps) and long (-3bps) segments following buying interest in the APR-2032 (-48bps) and JUN-2053 (-26bps) bonds, respectively.

A total of 43,710 units valued at N46.280 million were traded this week in 23 deals compared with a total of 3,521 units valued at N3.710 million transacted last week in 10 deals.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com