…Trading activities in the T-bills secondary market were bullish, as the average yield contracted by 4bps to 23.1%

…The overnight lending rate contracted by 33bps to 33.0% inflows from FGN bond coupon (NGN28.22 billion).

…Aradel Holdings Plc, indigenous energy company, was listed today by Introduction on the NGX Exchange

MON OCT 14 2024-theGBJournal| The NGX benchmark index, the All-Share Index, climbed 62bps to close at 98,215.13 points, to start the week on bullish sentiments.

Gains in GTCO (+1.84%), ZENITHBANK (+0.13%), and FBNH (+0.96%) offset selloffs in ACCESSCORP (-0.51%), FIDELITYBK (-0.68%) and STERLINGNG (-3.61%).

The ASI year-to-date return increased to 31.35%, while the market capitalization gained N3.42 trillion to close at N59.51 trillion

Analysis of today’s market activities showed trade turnover settled higher relative to the previous session, with the value of transactions up by 251.96%. A total of 304.97m shares valued at N19.71 billion were exchanged in 8,083 deals.

CUTIX (-3.09%) led the volume chart with 37.93m units traded, while ZENITHBANK led the value chart in deals worth N1.28 billion

Market breadth closed negative at a 0.58-to-1 ratio with declining issues outnumbering the advancing ones. VITAFOAM (-9.09%) topped thirty others on the laggard’s table, while WAPIC (+10.00%) led seventeen others on the leader’s log.

Trading activities in the T-bills secondary market were bullish, as the average yield contracted by 4bps to 23.1%.

Across the curve, the average yield contracted at the short (-4bps), mid (-4bps), and long (-5bps) segments following interests in the 87DTM (-4bps), 178DTM (-5bps), and 346DTM (-5bps) bills, respectively.

Similarly, the average yield contracted by 6bps to 25.9% in the OMO segment.

Elsewhere, the FGN bond secondary market traded on a calm note, as the average yield closed flat at 18.9%.

Across the benchmark curve, the average yield pared at the short (-1bp) end, driven by the demand for the MAR-25 (-9bps) bond, but closed flat at the mid and long segments.

The overnight lending rate contracted by 33bps to 33.0% inflows from FGN bond coupon (NGN28.22 billion).

At the currency market, The naira appreciated by 5.7% to N1,552.92/US$1 in the Nigerian Autonomous Foreign Exchange Market (NAFEM).

In another major development in the Market, Aradel Holdings Plc, indigenous energy company, was listed today by Introduction on the NGX Exchange and engaged capital market stakeholders in a Fact Behind the Listing Presentation.

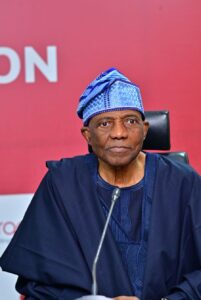

The company was introduced to the market by Dr. Umaru Kwairanga, Group Chairman of NGX, who introduces the NGX team and invited Aradel Holdings Plc to the historic occasion.

During the opening remarks, Alhaji (Dr.) Umaru Kwairanga, Group Chairman of NGX, along with Mr. Temi Popoola, Group Managing Director/CEO, and Mr. Jude Chiemeka, CEO of NGX, share their insights on the significance of today’s listing and its role in driving Nigeria’s energy future.

Mr. Ladi Jadesimi, Chairman of Aradel Holdings, introduced the Aradel delegation, marking the start of an exciting new chapter in Nigeria’s energy journey.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com