THUR, AUGUST 03 2023-theGBJournal |Bullish sentiments persisted in the local bourse as investors’ interest in MTNN (+6.5%) triggered a 1.6% increase in the benchmark index.

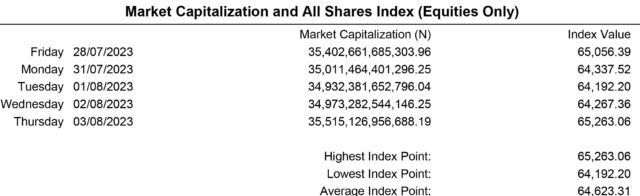

Eventually, the NGX ASI closed at 65,263.06 points, while the Year-to-Date return increased to +27.3%.

The total volume traded advanced by 34.6% to 445.28 million units, valued at NGN5.09 billion, and exchanged in 7,095 deals. STERLINGNG was the most traded stock by volume at NGN69.45 million, while ACCESSCORP was the most traded stock by value at NGN568.98 million.

On sectoral performance, the Banking (+3.2%), Insurance (+2.5%), and Consumer Goods (+2.2%) indices recorded gains, while the Industrial Goods index closed flat. Conversely, the Oil & Gas (-0.6%) index was the sole loser of the day.

As measured by market breadth, market sentiment was largely positive (5.1x), as 51 tickers gained relative to 10 losers. STERLINGNG (+10.0%) and NB (+10.0%) topped the gainers’ list, while ETERNA (-9.8%) and JOHNHOLT (-9.8%) recorded the highest losses of the day.

The naira depreciated by 4.5% to N776.50/USD at the I&E window.

The overnight lending rate expanded by 21bps to 1.6%, in the absence of any significant funding pressure on the system.

The Nigerian Treasury bills secondary market traded quietly, as the average yield closed flat at 7.1%.

Activities in the FGN bond secondary market were bearish, as the average yield expanded by 5bps to 13.3%. Across the benchmark curve, the average yield expanded at the short (+14bps) and long (+2bps) ends as investors sold off the MAR-2025 (+67bps) and JUN-2053 (+20bps) bonds, respectively. Elsewhere, the average yield was unchanged at the mid segment.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com